23.01.2023

15 minutes of reading

Biofuels in the road transport sector

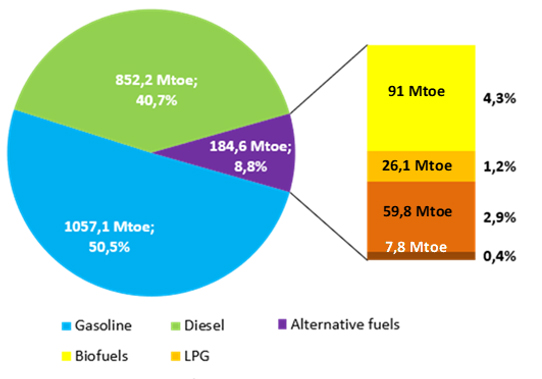

In 2021, global energy consumption in the road transport sector amounted to just over 2.1 Gtoe. Compared to 2020, the year of the health crisis, consumption increased by 7% to a level that is still 4% lower than the pre-COVID level in 2019.

The share of alternative fuels and powertrains to oil-based gasoline and diesel fuels (biofuels, LPG1, NGV2 and electricity) is up by more than 6% compared to 2020 and by 2% compared to 2019. In 2021, it represented 8.8% of the fuels consumed, i.e. nearly 185 Mtoe. Among these alternatives, biofuels accounted for 91 Mtoe, i.e. a market share of 49.3% of these alternatives and 4.3% of all fuels consumed (Fig.1). After plummeting by more than 7% between 2019 and 2020, biofuel consumption bounced back by 3.7% but still did not reach its 2019 record level.

Source: IFPEN, from Enerdata and IHS

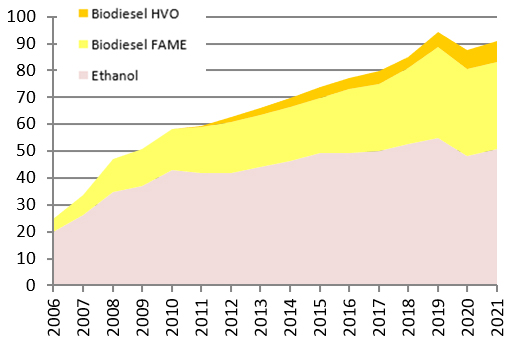

Among biofuels consumed in 2021, bioethanol, the main substitute for gasoline, began to show growth again, as did gasoline consumption, which has not quite recovered its pre-crisis level. The global consumption of ethanol thus reached nearly 51 Mtoe in 2021 (compared to 54.7 in 2019). As for biodiesel substitutes for diesel, they have started climbing again, reaching a record level of 40 Mtoe, despite the consumption of fossil diesel remaining below the level of 2017 (Fig. 2). This momentum in the biodiesel market is mainly due to the increase in demand for HVO (Hydrotreated Vegetable Oil) where the flexibility of the process and the quality of the fuels produced is well suited to oil companies.

Source: IFPEN, from IHS

At continental scales, the incorporation rates of all biofuels into road fuels have remained stable since 2019. They vary depending on the region, but Latin America continues to boast the highest rate thanks to its ethanol market: ethanol alone has an incorporation rate close to 15% (energy), in all types of gasoline. North America and the European continent follow, with respective rates of 6.5% and 5.2% respectively. In Asia, this rate has been rising every year and reached 2.3% in 2021.

In Europe, although biofuel consumption reached a record high of nearly 18 Mtoe in 2019, the health crisis prompted a drop of about 5% in 2020. Whereas, for Member States of the European Union, the level remained almost stable. In 2021, the level of consumption returned to pre-crisis levels thanks to the economic recovery and the national incorporation mandates required by the European Commission’s RED3 and FQD4 Directives. In terms of incorporation rates, the situation remained stable and close to 7% LHV in the road transport sector, excluding the multiplying factor.

In North and South America, consumption fell by 10% in 2020. In 2021, the United States, followed by Brazil, were still the top two global players in the biofuels market, although their consumption levels have not returned to the levels of 2019. The situation is quite different in Asia. As such, although the total energy demand of the transport sector struggled to return to its 2019 levels, the growth rate of biofuel consumption remained positive during the health crisis and continued its upward trend in 2021.

Gasoline substitutes

Since the emergence of the biofuel market, ethanol has remained the primary substitute to gasoline fuels used around the world. Worldwide, the growth of its consumption has been estimated at +6% in 2021. The United States continues to be the biggest producer, followed by Brazil. The two countries alone account for 81% of the global market. However, it was in Asia-Pacific that the growth rate was the highest at over 28%. More than 5 Mtoe were consumed in 2021, 70% of which were consumed by China and India.

.jpg)

Source: IFPEN, from IHS

In Europe, the demand for fuel ethanol has returned to its pre-COVID crisis level. The introduction of E10 in new markets such as the United Kingdom and Sweden has also contributed to the increase in the global incorporation rate.

Only Latin America, and more specifically Brazil, has witnessed a further decline in its ethanol market, continuing the trend observed during the 2020 crisis. Unfortunately, in 2021, bad weather conditions (drought followed by frost) severely impacted the sugarcane harvest, drastically reducing its yield as well as that of the sugar. The ethanol and sugar markets have also suffered a significant slump (-9% and -16% respectively). Meanwhile, there was a continued increase in the use of corn for ethanol production.

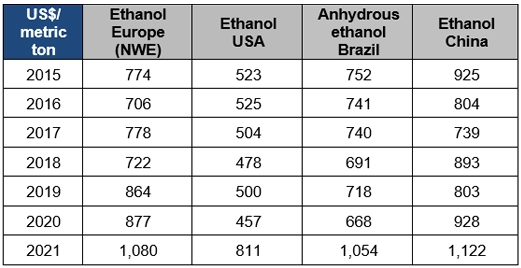

The combination of the upturn in fuel sales, rising oil prices, and difficulties in obtaining access to certain agricultural resources from Ukraine meant that 2021 was marked by record market prices for biofuels (Table 1, Table 2 and Table 3), particularly at the end of the period.

Source: IFPEN, from Argus

For the ethanol segment, the rise in wheat prices thus clouded the outlook for the year 2022. In Russia, the Kremlin not only introduced an export tax on wheat, but also capped exports for part of the 2021/22 season. Governments concerned about the impact of high prices on the world market for key food and feed commodities often exhibit a bias towards intervention that is not conducive to ethanol supply adjustment.

Diesel substitutes

Two main biofuels are currently incorporated into the road diesel fuel pool: FAME5 and HVO6. They use biomass resources containing fatty acids, such as oil crops (rapeseed, palm, soybean, etc.) or used cooking oils or animal fats. Unlike FAME, the incorporation of which is limited to a maximum of 10% vol. in diesel distributed at the pump in the European Union, there is no limit to the amount of HVO that can be incorporated in the mix. The youngest industry, but one that is enjoying strong growth, HVO represented 16% of biodiesels consumed globally in 2021 (Fig. 2).

After a slowdown in the growth of the global biodiesel market in 2020, the year 2021 was marked by a noticeable recovery. However, this was clearly impacted by the prices of biofuel feedstocks that reached record highs in 2021.

%20production%20movements%20by%20zone%20(in%20billions%20of%20liters).jpg)

Source: IFPEN, from IHS

In the EU, historically the largest producer and consumer of biodiesel, most biodiesel producers suffered from a lack of inputs combined with a sharp increase in the price of both local and imported vegetable oils. Production and incorporation levels dropped slightly for the second year in a row. However, the share of biodiesel produced from used fat, oil and grease (UCO7, animal fats, PFAD8, tall oil, etc.) kept on growing, mainly thanks to imports, namely from China.

In the United States, the incorporation of biodiesel rose by 7.5% between 2020 and 2021, mainly due to the expansion of the HVO market, which accounts for 40% of incorporated biodiesel (compared to 35% in 2020). This rise is largely due to a surge of more than 20% in HVO imports, whereas domestic biodiesel production grew by only 3.2%. It should be noted that HVO production capacities are currently on track to exceed the capacities of the FAME plants in operation in the summer of 2022 (i.e. more than 6.2 Mtoe). Regarding feedstocks, the share of recycled oils has grown to almost 33% of all oils and fats mobilized. Out of the 67% of vegetable oils that complete this mix, soybean oil still accounts for the majority (52%).

In both Asia and South America, biodiesel markets have rebounded positively and exceeded pre-crisis production levels, with growth compared to 2019 of +24% in Brazil and +17% in Indonesia, which are the two main producing countries on these continents. However, in Brazil, increased demand for soybeans on the world market and fears of rising fuel prices have prompted a reduction in the biodiesel incorporation mandate, which was extended to 2022. At the same time, the planned introduction of higher biodiesel mandates in Indonesia (B-409 versus B-30 currently) and Malaysia (B-20 versus B-10) has been delayed. High palm oil prices are one of the main reasons why these decisions to postpone were taken.

In the same way as for ethanol market prices, biodiesel prices rose to record levels.

![Table 2 - Annual FAME biodiesel price changes by zone [US$/t]](/sites/ifpen.fr/files/inline-images/NEWSROOM/Regards%20%C3%A9conomiques/Etudes%20%C3%A9conomiques/Biocarburants%202022/VA-Table%202-Annual%20FAME%20biodiesel%20price%20changes%20by%20zone.jpg)

Source: IFPEN, from Argus

![Table 3 - Annual European HVO biodiesel prices for different resource classes [US$/t]](/sites/ifpen.fr/files/inline-images/NEWSROOM/Regards%20%C3%A9conomiques/Etudes%20%C3%A9conomiques/Biocarburants%202022/VA-Table%203-Annual%20European%20HVO%20biodiesel%20prices%20for%20different%20resource%20classes.png)

Source: IFPEN, from Argus

* Class I : HVO from food crops, enabling a reduction in greenhouse gases of 65% min.

**Class II : HVO from recycled vegetable oils (UCO, POME), enabling a reduction in greenhouse gases of 85% min.

***Class III : HVO from category 3 animal fats, enabling a reduction in greenhouse gases of 80% min.

In addition to ongoing price volatility caused by the various health and energy crises, the European biodiesel market experienced a shortage of catalysts for the FAME industry at the end of the third and fourth quarters and a short-term squeeze on immediate supplies. This was reflected in particularly high spot prices.

Spotlight on biofuels in the aviation sector

With the growing awareness of the existing environmental impacts of international air travel (which accounts for 13% of CO2 emissions in the transport sector) and given the sector’s growth outlook (pre COVID-19), Member States of the International Civil Aviation Organization (ICAO) adopted a greenhouse gas stabilization objective from 2020. Furthermore, at the General Assembly held in the fall of 2022 the ICAO pledged to reduce net carbon emissions to zero by 2050. In order to achieve these objectives, the use of Sustainable Aviation Fuels (SAF10) is seen as the principal lever for reducing emissions along with carbon offsetting scheme of the CORSIA11.

There are currently nine ASTM-approved SAF, including some that are already mature or close to industrial maturity, such as HEFA-SPK12, coproduct of HVO biodiesel units, FT-SPK13, coproduct of the BtL and e-fuel processes for the production of Fischer-Tropsch synthetic biodiesel, and ATJ-SPK14, derived from the conversion of ethanol or isobutanol into synthetic kerosene. These alternative fuels are currently approved for incorporation in traditional kerosene, with a maximum limit of 50% vol. in the blend.

Europe has 8 industrial production sites capable of marketing biokerosenes (excluding production sites that co-process biomass with fossil feedstocks in refineries). These are exclusively HVO units capable of producing HEFA-SPK, up to a capacity of approximately 4 Mt/year. Additionally, there are approximately 15 other projects aiming to commercialize HEFA-SPK, FT-SPK using the biomass-to-liquid technology and ATJ by 2025, as well as 4 FT-SPK projects using the efuels technology.

By 2030, IATA15 estimates world production capacity to be around 24 Mt, including 8 Mt in the United States. Despite these prospects, only a few hundred kilotons of SAF were marketed to airlines in 2021. Even though stakeholders have been particularly active in terms of partnership agreements and incorporation targets, the cost premium between SAF and conventional jet fuel is still quite high (a factor of 2 to 2.5). All market players are waiting for an incentive-based, stable and long-term regulatory framework to secure market deployment.

In terms of regulations, on the American continent, the United States, Canada and Brazil have initiated their policy of encouraging the consumption of alternative fuels, but so far, only the United States has a mandate dedicated to SAF. In Asia, only Indonesia has rolled out its SAF deployment policy since 2013. Two other countries where regulations were being drafted in 2021 are New Zealand and Japan.

In the European Union, following the publication of the European Commission’s "RefueL EU Aviation" incorporation targets in July 2021 (see Biofuels 2021 Dashboard), a trialogue is currently underway with the Parliament and the Council to finalize the targets for the 2030 and 2050 timeframes.

In France, an incentive tax and a 1% incorporation target have been specifically defined in the 2022 finance law for renewable jet fuels. Furthermore, amidst the ongoing operations to promote the deployment of SAF (see Biofuels 2021 Dashboard), ADEME, the French Environment and Energy Management Agency, should shortly announce the projects selected to receive investment aid for a first aviation biofuel production demonstration plant at industrial scale. In October 2022, Air France-KLM also signed two contracts with SAF producers for the supply of 1.6 Mt of fuel starting in 2023.

Biomethane for NGV powertrains

An as yet minority renewable fuel, its consumption is nevertheless increasing in some zones where natural gas has historically figured among road fuels. Currently primarily produced by the anaerobic digestion of organic waste (methanization), or via the recovery of landfill gas, biogas is a renewable fuel principally used for heat and electricity production. Only a fraction (less than 10%) is currently purified to obtain biomethane suitable for injection into the natural gas network or used as a fuel in dedicated vehicle engines.

In the United States, NGV fleets made up of heavy trucks, buses and waste collection vehicles, have grown significantly in recent years. In 2021, NGV consumption rose by 11% and the quantity of bio-NGV rose by more than 12% to reach nearly 2 Mtoe. 85% of this bio-NGV is consumed in the form of compressed natural gas (CNG), while the remaining part is consumed in liquefied form (LNG).

Biomethane motor fuel consumption is also picking up pace in Europe. Primarily obtained via the fermentation of organic waste, biomethane motor fuel is considered in European regulations as an advanced biofuel, thereby contributing to REDII 2030 targets. The two main countries using bio-NGV are Sweden and Italy. Strong growth dynamics were also observed in the United Kingdom, Germany, the Netherlands and France. In Sweden, the NGV sector represents 63% of the biogas produced. In Italy, NGV vehicles accounted for 2% of the cars on the road in June 2021. In the UK, with “Zero Emission” national targets set for 2030, NGV trucks and other delivery vehicles are being extensively developed for use with renewable gas. In France, the impetus is most pronounced for powering the bus fleet and other heavy vehicles (see next paragraph).

Focus on France

In 2021, France incorporated a total of 4.5 million m3 (or 3.16 Mtoe) of liquid biofuels in the fuels distributed throughout the country, up 8% from 2020. Most of these biofuels are diesel substitutes (2.37 Mtoe), followed by gasoline substitutes (0.77 Mtoe) and for the first year, a share of jet fuel substitutes (0.013 Mtoe).

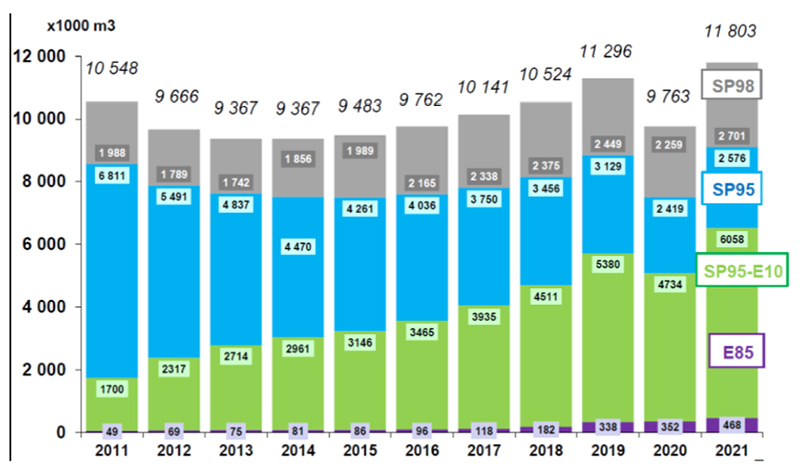

Since 2017, SP95-E1016, a fuel which contains up to 10% by volume of ethanol, has been the most consumed fuel by French gasoline vehicle owners, with a market share of more than 51% in 2021. Superethanol E85 (gasoline containing up to 85% ethanol by volume), dedicated to Flex-fuel vehicles and gasoline vehicles fitted with conversion boxes, continued its growth, with a market share of 4% of gasoline and a total consumption up 33% compared to 2020. The number of service stations distributing E85 also continued to grow. This fuel is now readily available in 30% of national service stations.

Source: SNPAA 2022 from CPDP (French Professional Oil Committee)

The year 2021 was also marked by a two-fold increase in the number of approved E85 conversion boxes fitted, i.e. a total of 135,000 petrol vehicles kitted out. Flex-fuel vehicle production model offerings are still dominated by Ford and Jaguar Land Rover. Ford unveiled a lineup of six new E85-compatible vehicles in 2021. Even though ethanol still accounts for the majority of gasoline substitutes, the share of HVH-E17 is on the rise, representing more than 8% in energy terms (and nearly 6% in volume terms) in the same year. With no mixing limits, this biofuel, obtained from HVO units, is not currently restricted by any specific indication at the pump.

In terms of fossil diesel substitution options, FAME and in particular, VOME18 continue to make up the majority (90% of the mix), followed by HVH-G19. Although the market remained stable in 2021 (+2% compared to 2020), the supply difficulties experienced across Europe also had an impact on France. Additionally, France has opted to move away from palm oil and then, from 2022, from soybean, to supply its biodiesel industry. Therefore, these restrictions are clearly reflected in the cost price of incorporated biodiesel, which has risen sharply.

It is worth noting that a decree is in the process of being drafted for using FAME at more than 7% volume as a substitute for domestic fuel oil for residential and industrial fuel-oil boilers.

Lastly, for biofuels, there is also a growing share of biomethane incorporated into NGV. In France, the total consumption of biogas for the transport sector has almost tripled between 2020 and 2021 to reach 1.7 ktoe. The segment with the largest share of NGV vehicles is light commercial vehicles (nearly 9600 vehicles by the end of 2021). Nevertheless, the sharpest growth in registrations occurred for buses (20% of all buses in 2020), followed by heavy goods vehicles and, finally, coaches. In 2021 the incorporation rate of bio-NGV in the NGV distribution network stood at 19.6%.

Outlook for carbon neutrality

Investment outlook

Global investment in liquid biofuels more than doubled in 2021, hitting just over 8 billion dollars. Two-thirds of this increase was in biodiesel, driven by higher investment in HVO, although investment in ethanol also nearly doubled. The United States and Brazil each accounted for about 30% of global investment in 2021. The forecasted capacity expansion for HVO projects for the production of renewable diesel and kerosene (such as Neste’s $1.98 billion investment in Rotterdam), is expected to create an estimated global supply of 32 million tons (Mt) in 2025 and 39 Mt in 2030. As for the European Union, supply should nevertheless peak at around 7 Mt due to regulatory constraints on the sustainability of feedstocks.

Investments in lignocellulosic pathways are still relatively limited, but are nevertheless taking shape in the United States, Eastern Europe and India (see 2021 Dashboard). In 2022, the second European lignocellulosic ethanol commercial plant, located in Podari, Romania, with an annual capacity of 50 kt of ethanol, was put into operation. Furthermore, for the same process, three plants planned in India are now in the construction phase. Lastly, as for the BtL process, out of the 6 plant projects in the United States, the first plant, owned by the Fulcrum company in Nevada, is now in the start-up phase. France is not lagging behind in this technology, with two new investment projects announced this year for the construction of the first two BtL plants, the BioTJet20 and Hynovera21 projects. These projects for the production of biokerosene and synthetic biodiesel, mainly from wood residues, will get their

investment decision confirmed in 2024 for a potential production start-up by 2027.

On the road to reinvigorating incentive policies?

In the EU, negotiators from the Member States, the Parliament and the Commission recently agreed that car manufacturers must reduce their CO2 emissions by 100% by 2035, which would make it impossible to sell new vehicles running on fossil fuels in the European Union. The agreement also calls for a 55% reduction in CO2 emissions for new cars sold from 2030 onwards compared to 2021 levels. Negotiators also agreed that a proposal on how cars running on “CO2-neutral fuels” could be sold after 2035 would be published in the near future. Within this timeframe, the guidelines for using biofuels in road passenger transport are currently being defined. In light of their significant environmental performance when evaluated over their entire life cycle, biofuels remain particularly attractive for use in aviation (see previous chapter) and maritime transport. In effect, the objectives of the "Fuel EU Maritime"22 proposal foresee achieving zero carbon emissions in the sector by 2050, while energy efficiency can only provide one third of the emissions reduction. This will then require the gradual deployment of low-carbon fuels from 2025. The EU proposal relies heavily on the adoption of renewable and low-carbon fuels and technologies, including ambitious targets for reducing the greenhouse gas density of marine fuels.

Looking beyond the annual RFS23 mandates, in August 2022, the United States approved the Inflation Reduction Act, which includes incentives for biodiesel, SAF, and advanced fuels, as well as support for biofuel infrastructures and production. Meanwhile, several U.S. states have passed their own laws to reduce carbon emissions, including the LCFS24 - or Low Carbon Fuel Standard - which is now ratified in California, Oregon and Washington State. Seven other states are also considering rolling out similar policies. This standard establishes annual carbon density thresholds which decrease over time, for fuels distributed at service stations. This policy aims to gradually reduce the amount of petroleum-based fuel in the transport sector over a 20-year period.

Lastly, one of the main recent events is the approval, in the summer of 2022, of the Canadian “Clean Fuel Regulation” (CFR) which will come into force in 2023. This policy aims to reduce greenhouse gas emissions in the transport sector by 26.6 Mt by 2030, with specific levels of emission reductions over the entire life cycle of gasoline and diesel fuels (-14.7% and -15% respectively). With the introduction of the CFR expected to bring about a significant increase in local biofuel production capacity, the government has announced that it will make 1.5 billion Canadian dollars available through the Clean Fuels Funds.

Nonetheless, at the present time, in the face of the energy price crisis, governments are displaying contrasting behaviors. In the EU, most of the measures that have been rolled out are aimed at lowering the cost of access to energy. As a result, some Member States are delaying or restraining the use of more expensive renewable energies. In contrast, in the USA and Argentina, biodiesel is being promoted as a means of offsetting possible shortages of fossil diesel. A crisis that adds uncertainty to the impetus of support measures for renewable fuels in the short term.

Deployment of industrial biogenic CO2 capture/storage solutions

To speed up the process of reducing the amount of CO2 in the atmosphere, or even to be able to compensate for fossil emissions that cannot be eliminated in the short term, various solutions aimed at preserving and developing carbon sinks are being examined. Today, carbon sinks primarily involve storing carbon from the atmosphere in natural elements such as biomass, soils with a high carbon stock in forestry and agricultural environments, wetlands, oceans, etc. While the efficiency and scale of such sinks can be improved, other types of “technological” solutions are also being pursued. These include BECCS or BioEnergy with Carbon Capture and Storage, which consists of capturing biogenic CO2 emissions from a biomass plant that produces bioheat, bioelectricity or biofuel. The captured CO2 can be reused and/or permanently sealed in different storage sites, such as geological reservoirs to avoid its return to the atmosphere...

Most ethanol production plants already capture CO2 from the fermentation stage and then use it in the food and beverage industry or for enhanced oil recovery applications such as in the United States. In 2017, the world’s first plant to capture carbon from a bioenergy unit was built in the United States, in an ethanol plant capturing 1 Mt of CO2 per year, for geological storage. Today, there are about 40 ethanol plants (including 30 in the Midwest Carbon Express project in the United States) that should start capturing CO2 by 2030. Around ten of them are considering storage in geological reservoirs with a potential to capture several tens of Mt of CO2/year.

Other biofuel processes can also play a role in generating carbon sinks, such as methanization, or potential future projects involving pyrolysis and gasification of biomass to produce synthetic biofuels, biomethane or even hydrogen. In the same way as ethanol, methanization, which produces biogas for injection into the natural gas network or into a NGV engine, can recover concentrated and relatively pure CO2, for which the costs of capture and treatment are lower. This suggests a significant potential for these processes to replace fossil fuels, as well as to remove CO2 from the atmosphere, which seems necessary to achieve carbon neutrality targets.

Daphné Lorne - daphne.lorne@ifpen.fr

[2] NGV: Natural Gas for Vehicles

[3] RED: Renewable Energy Directive

[4] FQD: Fuel Quality Directive, Directive 2009/30/EC

[5] FAME: Fatty Acid Methyl Ester

[6] HVO: Hydrotreated Vegetable Oil

[7] UCO: Used Cooking Oil

[8] PFAD: Palm Fatty Acid Distillate

[9] B-40: Diesel fuel with a 40% volume of biodiesel

[10] SAF: Sustainable Aviation Fuels

[11] CORSIA: (Carbon Offsetting and Reduction Scheme for International Aviation)

[12] HEFA-SPK: Hydroprocessed Esters and Fatty Acids – Synthetic Paraffinic Kerosene

[13] FT-SPK: Fischer-Tropsch – Synthetic Paraffinic Kerosene

[14] ATJ-SPK: Alcohol-to-jet - Synthetic Paraffinic Kerosene

[15] IATA: The International Air Transport Association

[16] SP95-E10: Lead-free 95 gasoline containing up to 10% by volume bioethanol

[17] HVH-E: Huiles végétales hydrogénées de type essence (synthetic gasoline hydrogenated from vegetable oils)

[18] VOME: Vegetable Oil Methyl Ester

[19] HVH-G: Huiles végétales hydrogénées de type gazole (synthetic diesel from hydrogenated vegetable oils)

[20] BioTJet

[21] Hynovera

[22] Fuel EU Maritime

[23] RFS: Renewable Fuel Standard Program

[24] LCFS : Low Carbon Fuel Standard