05.11.2025

4 minutes of reading

The concept of critical raw materials initially referred to materials that were essential to national security but for which supply was limited. It has since been expanded to include needs associated with the energy and digital transitions, reflecting the increased demand for metals such as lithium, copper, and rare earths. In a context of geopolitical tensions, identifying and securing access to these resources has become a strategic priority for governments and businesses. But how should criticality be assessed? A thesis conducted at IFPEN, which has been published [12], offers a detailed examination of the issue, highlighting its complexity.

Securing access to critical metals for the transitions underway

The concept of critical raw materials emerged in the United States during the interwar period. It related to materials that were considered to be essential to national security but for which supply was limited. Since then, the concept has evolved in parallel with shifting strategic priorities, which are now determined not only by defense, but also by the energy and digital transitions.

These transitions are driving a sharp increase in the demand for certain metals and minerals (such as lithium, copper, and rare earths) that are essential to low-carbon and digital technologies [1]. Against a backdrop of growing of geopolitical tensions, securing access to these resources has once again become a fundamental issue for both governments and businesses. To better anticipate potential vulnerabilities, numerous public and private players carry out criticality studies aimed at identifying the most exposed markets [2].

The criticality matrix

Although there is still no single definition or methodology for assessing criticality, most existing studies are based on the theoretical framework defined by the National Research Council in 2008. This approach conceptualizes criticality not as a categorization, but as a continuous measurement assessed according to two dimensions: importance in use and supply risk. Importance in use is determined by the cost or impact of a supply disruption, while supply risk represents the probability of such a disruption. These two criteria are combined in a two-dimensional graphical representation called a criticality matrix (Figure 1a). The higher up and the further to the right a metal is on this matrix, the more critical it is considered to be. Thresholds can be applied on both axes to define a list of critical materials, as illustrated in Figure 1b.

However, the determination of these two criteria varies between studies, from the selection of the indicators used to the way in which they are aggregated. Numerous articles in the literature question the relevance of the indicators used and recommend identifying best practices, primarily through the acquisition of empirical evidence [3-5]. A PhD thesis was therefore initiated at IFPEN to assess the relevance of one indicator in particular: the geographical concentration of raw material production.

Definition and use of the HHI Index

Geographical concentration of production is the most commonly used indicator for assessing supply risk [6] . The underlying idea is simple: the more concentrated the production of a metal is in a small number of countries, the greater the likelihood of supply disruptions due to various factors, including economic, political, and environmental ones [7].

To measure this concentration, most studies use the Herfindahl–Hirschman Index (HHI), a well-established tool in economics [8-9]. This index is expressed as the sum of the squares of the market shares of each producing country. The more production is dominated by one or a few countries, the higher the HHI will be; conversely, a fragmented market will result in a low index.

In American competition law, this index is interpreted according to three standard thresholds: a market is considered to be unconcentrated if the HHI is below 1,500, moderately concentrated between 1,500 and 2,500, and highly concentrated above 2,500 [10]. These same thresholds have been used, almost unchanged, in criticality studies of raw materials to identify the metals most at risk. However, these values have never been truly validated empirically in the context of criticality studies.

HHI validity as a criticality indicator

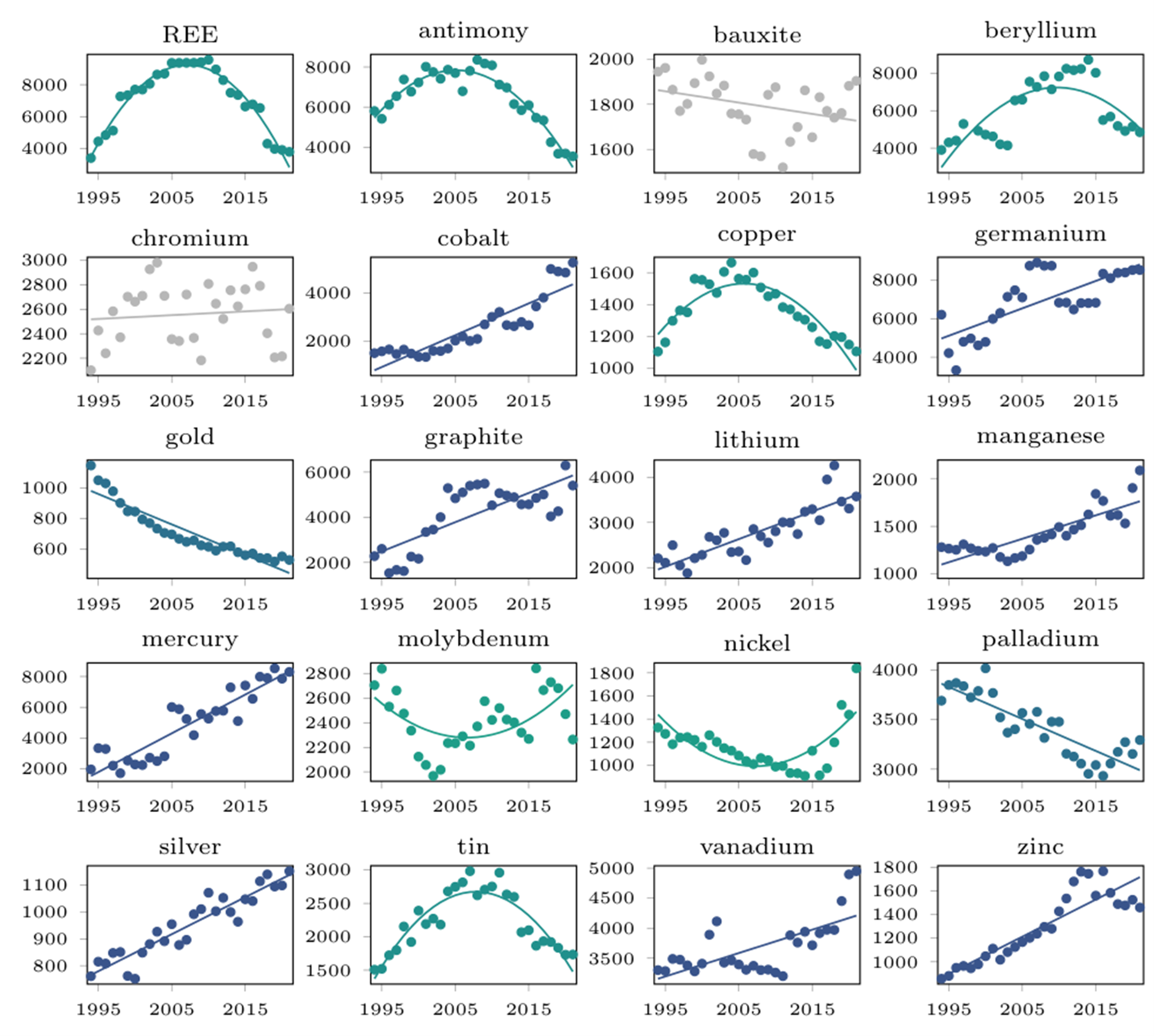

The research conducted aimed to assess the relevance of the HHI index and associated thresholds, based on the hypothesis set out by Gleich et al. [11] whereby market prices partly reflect their level of criticality. Based on this hypothesis, the relationship between the HHI and prices was analyzed over the period 1994–2021, using data covering 33 strategic metals (Figure 2). Panel econometric models were used to study the impact of variations in the geographical concentration of metal production on price dynamics.

1 A panel analysis combines data for several entities (in this case, metals) observed over several years (in this case, between 1994 and 2021).

The results of the study [12] present two major contributions:

- Firstly, they reveal that fluctuations in the HHI are associated with greater price variations when production concentration is relatively low. This challenges the widespread assumption that risks are most acute in highly concentrated markets.

- Secondly, the analysis does not identify any clear threshold for differentiating between metals with a high supply risk and those with lower exposure, highlighting the limitations of applying fixed concentration thresholds in criticality assessments.

NB: High HHI values indicate a higher concentration of production. Data sources: values calculated from USGS and BGS data.

Consequently, these findings suggest that relying on the HHI, particularly in combination with thresholds, may lead to an underestimation of supply vulnerabilities in markets that otherwise appear to be diversified.

Such interdependencies preclude simplistic interpretations.

More generally, this work highlights the need for caution when interpreting production concentration as a form of resource weaponisation. Public debates often focus on the potential risk posed by dominant producers, particularly China, exploiting their position. However, as Massot [13] points out, the complexity of metal supply chains and their multiple interdependencies make their effective use for geopolitical purposes much more difficult in practice.

References :

[1] IEA (2021): The Role of Critical Minerals in Clean Energy Transitions. IEA. Paris.

>> Available online at https://www.iea.org/reports/the-role-of-critical-minerals-in-clean-energy-transitions

[2] Schrijvers, Dieuwertje; Hool, Alessandra; Blengini, Gian Andrea; Chen, Wei-Qiang; Dewulf, Jo; Eggert, Roderick et al. (2020): A review of methods and data to determine raw material criticality. In Resources, Conservation and Recycling 155, p. 104617.

>> https://doi.org/10.1016/j.resconrec.2019.104617

[3] Achzet, Benjamin; Helbig, Christoph (2013): How to evaluate raw material supply risks—an overview. In Resources Policy 38 (4), pp. 435–447.

>> https://doi.org/10.1016/j.resourpol.2013.06.003

[10] Federal Trade Commission (2010): Commentary on the Horizontal Merger Guidelines.

>> Available online at https://www.ftc.gov/sites/default/files/attachments/merger-review/100819hmg.pdf

[7] Frenzel, M.; Kullik, J.; Reuter, M. A.; Gutzmer, J. (2017): Raw material ‘criticality’—sense or nonsense? In J. Phys. D: Appl. Phys. 50 (12), p. 123002.

>> https://doi.org/10.1088/1361-6463/aa5b64

[4] Glöser, Simon; Tercero Espinoza, Luis; Gandenberger, Carsten; Faulstich, Martin (2015): Raw material criticality in the context of classical risk assessment. In Resources Policy 44, pp. 35–46.

>> https://doi.org/10.1016/j.resourpol.2014.12.003

[5] Hatayama, Hiroki; Tahara, Kiyotaka (2018): Adopting an objective approach to criticality assessment: Learning from the past. In Resources Policy 55, pp. 96–102.

>> https://doi.org/10.1016/j.resourpol.2017.11.002

[6] Helbig, Christoph; Bruckler, Martin; Thorenz, Andrea; Tuma, Axel (2021): An Overview of Indicator Choice and Normalization in Raw Material Supply Risk Assessments. In Resources 10 (8), p. 79.

>> https://doi.org/10.3390/resources10080079

[9] Herfindahl, O. (1950): Concentration in the U.S. Steel Industry. Columbia University, New York, NY, USA.

[10] Hirschman, Albert Otto (1945): National power and the structure of foreign trade. Berkeley, Los Angeles, London: University of California press (Studies in international political economy).

[11] Gleich, Benedikt; Achzet, Benjamin; Mayer, Herbert; Rathgeber, Andreas (2013): An empirical approach to determine specific weights of driving factors for the price of commodities—A contribution to the measurement of the economic scarcity of minerals and metals. In Resources Policy 38 (3), pp. 350–362.

>> https://doi.org/10.1016/j.resourpol.2013.03.011

[12] Bucciarelli, Pauline; Hache, Emmanuel; Mignon, Valérie (2025): Evaluating criticality of strategic metals: Are the Herfindahl–Hirschman index and usual concentration thresholds still relevant? Energy Economics 143 108208

>> https://doi.org/10.1016/j.eneco.2025.108208

[13] Massot, P. (2025): Critical minerals: "We need a finer understanding of China’s vulnerabilities". ESSEC Institute for Geopolitics and Business.

>> Available online at https://institute-geopolitics-business.essec.edu/blog/critical-minerals-we-need-a-finer-understanding-of-china-s-vulnerabilities

Scientific contact: Emmanuel HACHE