The period 2012-2020, during which IFP School hosted the teaching and research Chair dedicated to this theme1 was also a period of fundamental change in terms of economic analysis of the environment and energy, with an increased interest in issues related to sustainable development.

The questions addressed in the framework of the Chair concerned the interactions between, on the one hand, energy and environmental changes related to the ecological transition and, on the other hand, economic growth and energy markets.

The results of the Chair’s activities highlighted the impact of market mechanisms on the energy mix2. The use of Markov regime-switching models has made it possible to highlight the effect of the development of intermittent renewable electricity production on electricity prices[1].

Thus, a low price regime is identified when the share of renewables in the electricity mix is high and a high price regime when the opposite is true. Consequently, increasing the proportion of wind and solar energies in the overall electricity production increases the probability of moving from a high price regime to a low price regime.

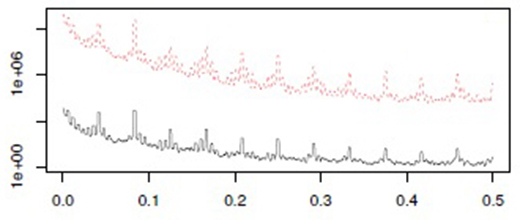

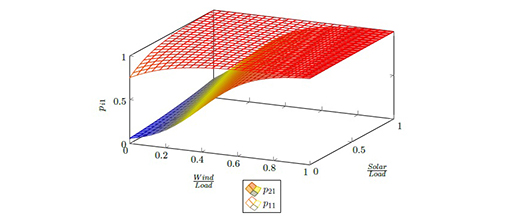

The figure below illustrates this phenomenon in two distinct ways using the German example, with:

- on the left, the market price of electricity being in line with the distribution of the residual load curve (non-renewable generation compensating for the intermittence of renewables);

- on the right, the probability of switching to a low price regime (vertical axis) which depends on the share of renewable energies in the electricity mix.

The Chair’s activities have been carried out through seven PhD theses and have resulted in multiple articles in peer-reviewed journals: for example, on the decarbonization of the electricity mix in oil-exporting countries[2] and on economic growth and the development of renewable energy[3].

These activities have also been reflected in the teaching programs offered at IFP School and have led to the organization of annual conferences to which foreign professors have been invited.

and the residual load curve (in red, MWh) in Germany (2014-2015)

as a function of the share of renewable energies in the electricity mix

1- Chair financed by the Tuck foundation

2- For example those obtained by C. De Lagarde (2018) “Promoting renewable energy : subssidies, diffusion, network price and market impacts”. Thesis defended at Paris Dauphine-PSL University.

3- Markov regime switching models are employed to describe business cycles, while allowing to identify shocks (crises, disruptions). Markov processes are those relating to random systems, whose future evolution depends on the past only on the basis of current information.

[1] C. de Lagarde , F. Lantz, 2018, How renewable production depresses electricity prices: evidence from the German market, Energy Policy, Vol 117, pp. 263-277

>> DOI: 10.1016/j.enpol.2018.02.048

[2] A. Farnoosh, F. Lantz, J. Percebois (2014), Electricity generation analyses in an oil-exporting country: Transition to non-fossil fuel based power units in Saudi Arabia. Energy 05/2014; 69.

>> DOI: 10.1016/j.energy.2014.03.017

[3] V. Court, P-A. Jouvet, F. Lantz, (2018), Long-term endogenous economic growth and energy transitions, The Energy Journal, Vol. 39, 1,

>> DOI: 10.5547/01956574.39.1.vcou

Scientific contact: Frédéric Lantz