26.05.2021

10 minutes of reading

Over the last twenty years, the production of aluminium has tripled and the ecological transition looks set to make ever greater use of this metal in low-carbon technologies. In addition to the pressure on resources, China's domination of refining activities and the resulting dependence for Europe in particular, there is also the environmental issue associated with this metal and its high carbon footprint.

- Aluminium: the second most used metal after iron

- Where is bauxite found? Who produces it?

- Should we be concerned about bauxite resources?

- What are the other risks facing aluminium?

- Video: aluminium in a nutshell

Podcast in French

Aluminium: the second most used metal after iron

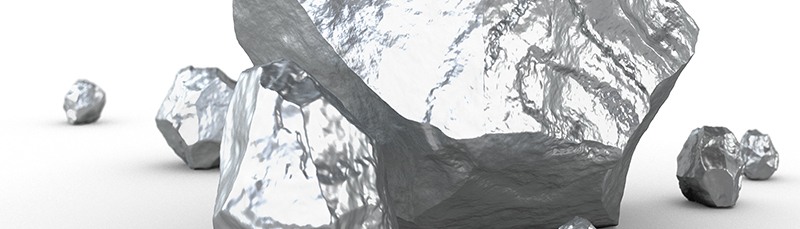

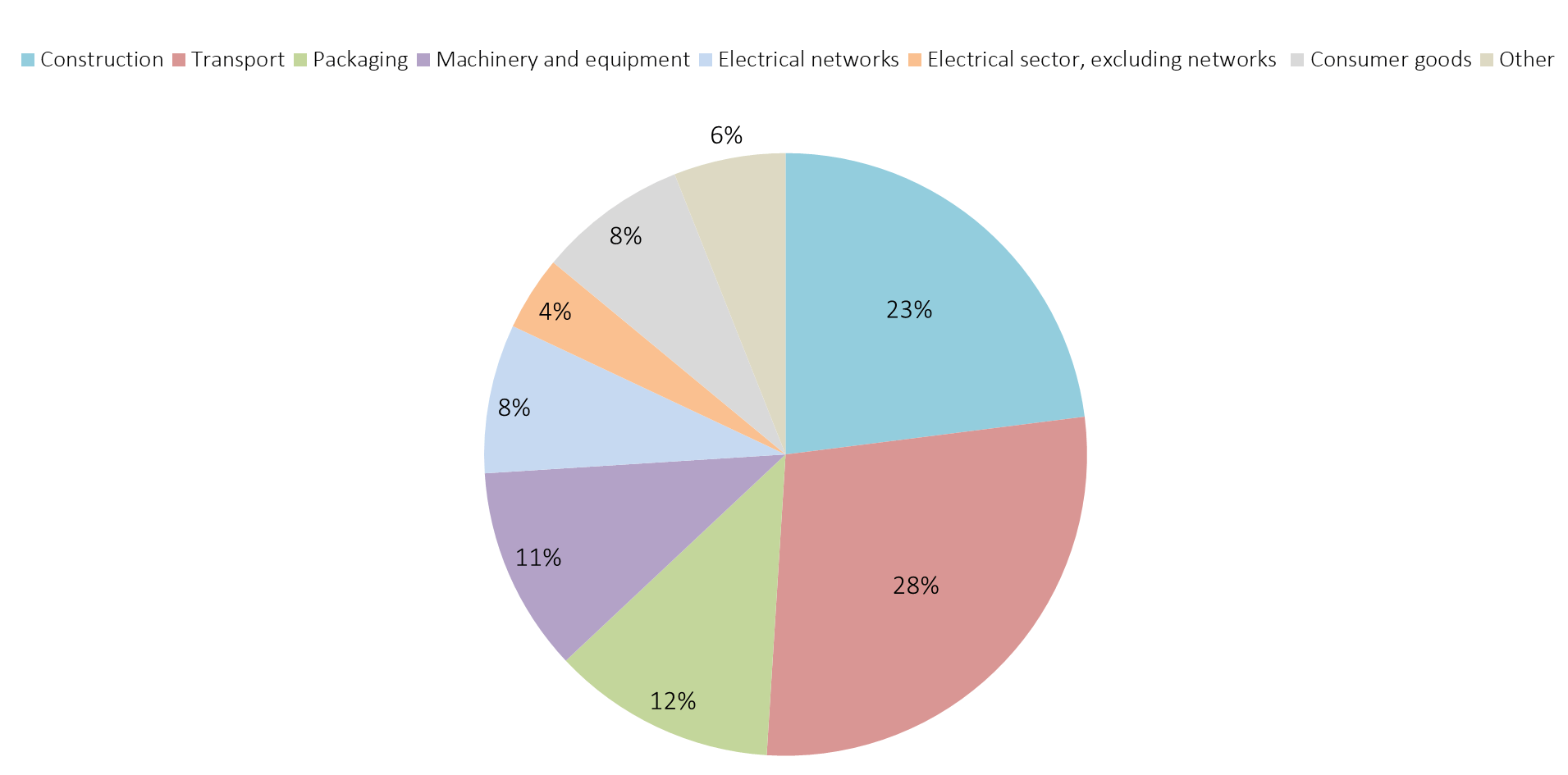

Aluminium is the second most abundant metallic element in the earth's crust after silicon, and the second most widely-used metal after iron. It is particularly prized for its malleability, its natural resistance to corrosion and its lightness to strength ratio. Aluminium has become an indispensable part of modern society and is used in many sectors of the economy, including transport, construction, the power sector and packaging (Figure 1).

Source: World Aluminum, 2018

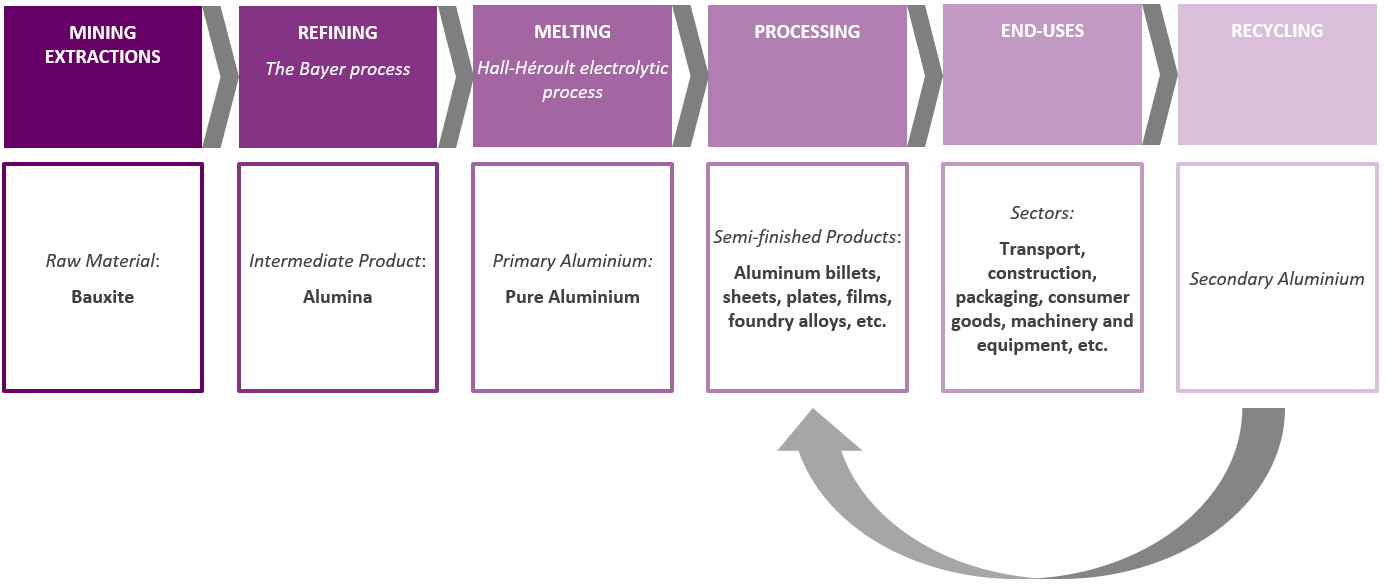

Although aluminium is found in many different minerals (mainly oxides and silicates), extracting it from them is a difficult task. For that reason, only bauxite is mined for aluminium production (El Latunussa, 2020). This ore, which is rich in alumina (Al2O3) and iron oxides, is then refined into an intermediate product, alumina, which is then smelted into aluminium (Figure 2).

Sources : OCDE, 2019; The Aluminium Association

Aluminium is increasingly used in low-carbon technologies. It is used in battery packaging, as a cathode in Lithium Nickel Cobalt Aluminium Oxide (NCA) batteries and in hydrogen fuel cells. Thanks to its lightness, it’s a key component in wind turbine nacelles and blades and can also be found in permanent magnets. In photovoltaic panels, aluminium is also widely used for frames and inverters. It’s also the material of choice for power connection infrastructures. Finally, the metal is widely used in the field of mobility because of its lightness as well as its resistance (Huisman et al., 2020).

Where is bauxite found? Who produces it?

Resources and reserves are located in tropical and subtropical regions

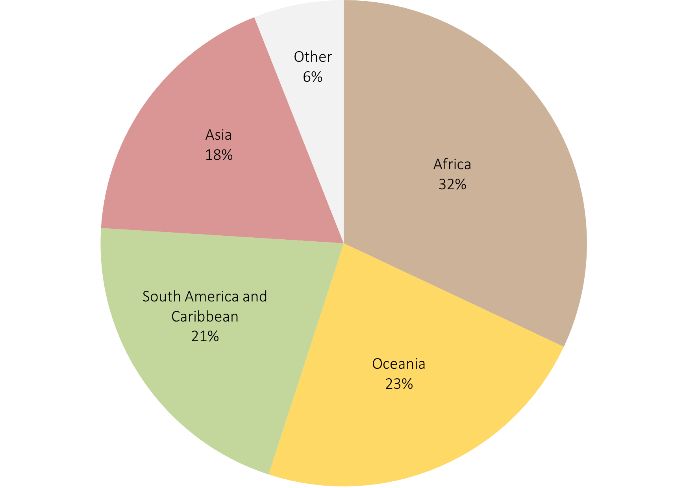

Bauxite resources are currently estimated at between 55 and 75 billion tons worldwide (Gt) (USGS, 2021). There are two main categories of bauxite deposits: karst bauxites are mainly located in the Caribbean (Jamaica), the Mediterranean (Greece, France), China, Russia (Central Urals) and Kazakhstan; lateritic bauxites, the main sources of world production, are found in Africa (Guinea), South Asia (India), Australia, North and South America (Hill and Sehnke, 2006) (Figure 3).

Source: USGS, 2021

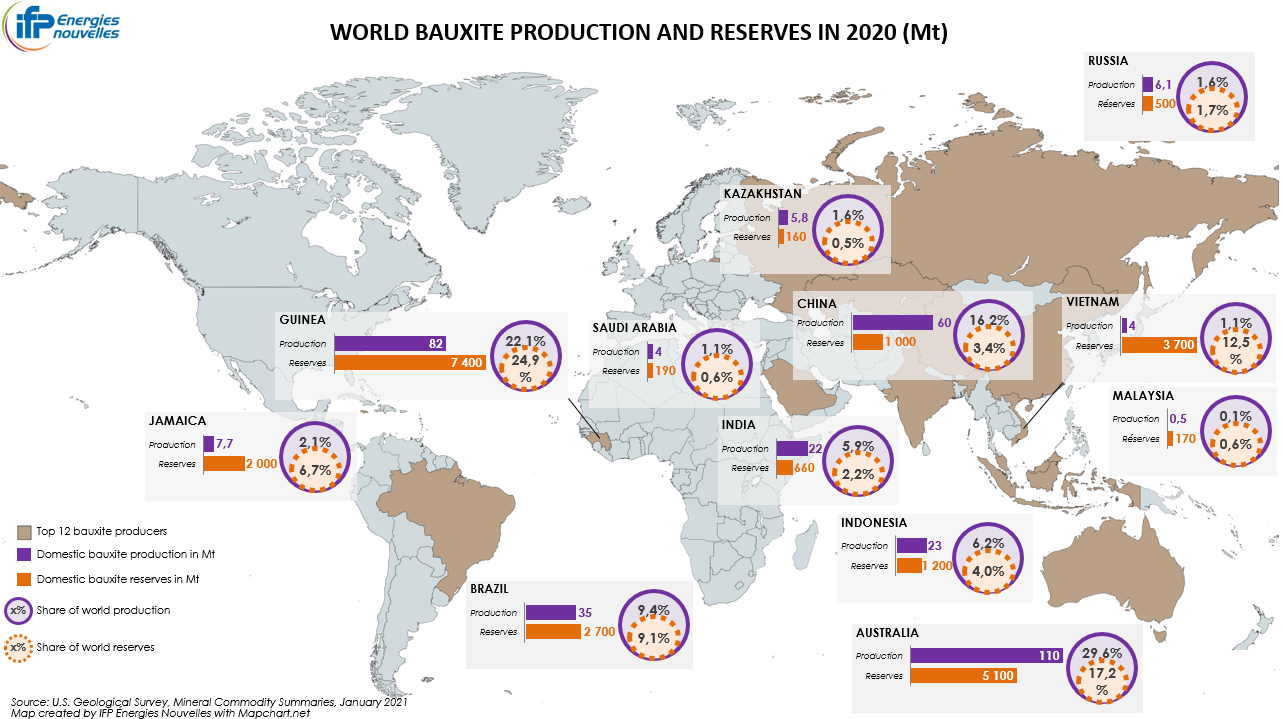

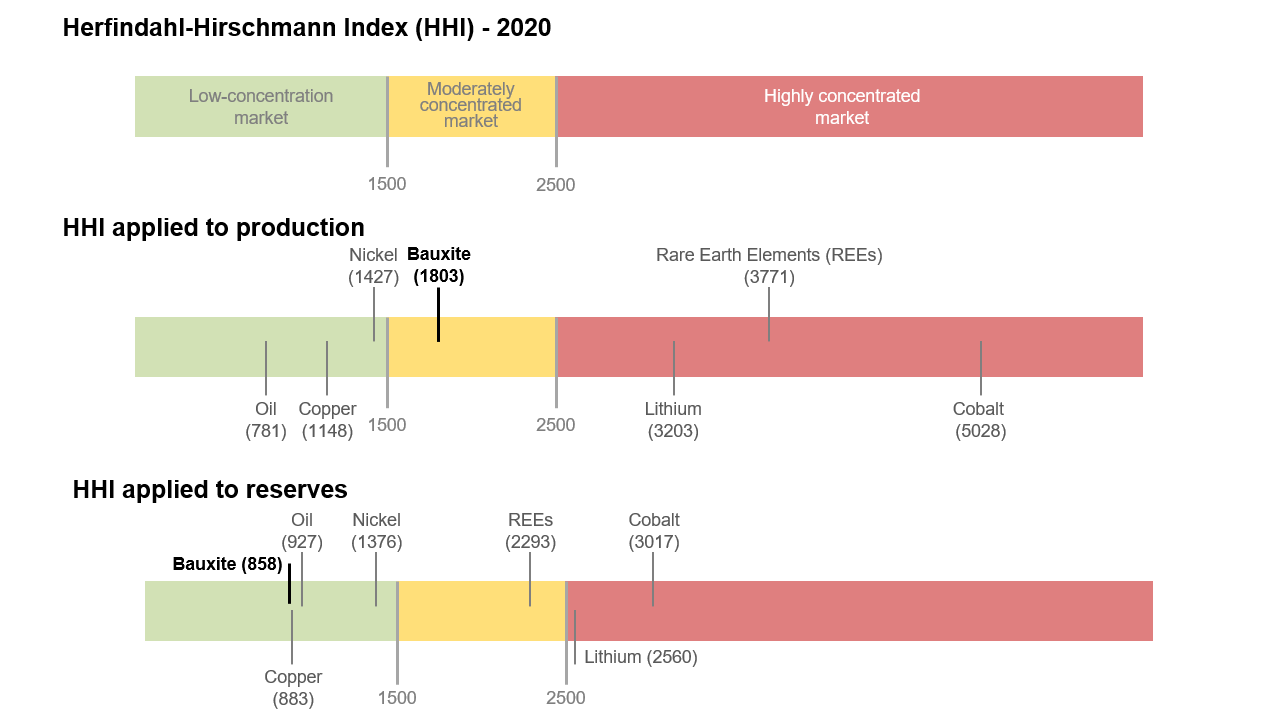

The U.S. Geological Survey (2021) estimates that world bauxite reserves are not concentrated (HHI of 858) (Figure 4) and amount to 30 Gt. They are mainly located in tropical or subtropical areas: Guinea (24.9%), Australia (17.2%), Vietnam (12.5%), Brazil (9.1%) and Jamaica (6.7%) (Map 1).

Source: USGS, 2021

A moderate concentration of mining production

The two countries with the largest bauxite reserves dominate extraction. Together, Australia (29.6%) and Guinea (22.1%) account for more than half of the world's mineral production. Although its own reserves are limited (3.4%), China accounts for 16.2% of production worldwide. Following this top three are Brazil (9.4%), Indonesia (6.2%) and India (5.9%). In Europe, four countries produce bauxite (Greece, France, Hungary and Croatia) but account for less than 1% of the global volume El Latunussa, 2020) (Map 1 and Figure 4) (USGS, 2021).

Source: USGS, 2021

It should also be noted that although Australia has been the leading producer of bauxite for more than two decades, its relative weight in world production has decreased (39% in 1996) due to the increasing weight of West African and Southeast Asian countries (USGS, 2021).

Also worth mentioning are the cases of Indonesia and Malaysia. Having been virtually absent from the bauxite mining landscape, Indonesia stormed into the global rankings in 2011 and accounted for nearly 20% of production in 2013 until the government banned exports of the mineral in January 2014, resulting in the collapse of the domestic production. Malaysia then experienced the same type of progression, with 12% of global production in 2015, before the Malaysian government also banned bauxite exports in 2016, giving as reason the proliferation of illegal logging and environmental damage (OECD, 2019).

The sector's mining landscape is dominated by large international groups that either own the mines outright or develop mining projects in joint venture with state-owned companies. There are the established companies such as Alcoa (USA) and Rio Tinto (UK/Australia) alongside the newcomers of the 2000s, mainly Chinese companies (the Chongqing-based Bosai Group, Chalco and the Hongqiao Group) and the state-owned Emirates Global Aluminium (UAE). The Australian companies (Alumina Limited, South 32) are also active in the field, as well as a few players from India (Hindalco Industries), Norway (Norsk Hydro) and Russia (UC Rusal) (OECD, 2019).

The alumina and aluminium production: a Chinese domination

Alumina

Alumina production has shifted from industrialized countries to countries with easy access to abundant resources and cheap electricity. It reached 136 million tons (Mt) in 2020, largely dominated by China (54%), whose production has increased sharply since the early 2000s. This growth in Chinese production has reduced the country's dependence on alumina imports, but it now finds itself exposed to fluctuations in the price of bauxite, since it relies on imports for almost half of its domestic consumption. Other alumina-producing countries include Australia (15%), Brazil (7%), India (5%) and Russia (2%) (USGS, 2021) (OECD, 2019).

The top 10 alumina producers include four Chinese groups (Chalco and the China Hongqiao, East Hope and Hangzhou Jinjiang groups), the US company Alcoa, the Anglo-Australian groups Rio Tinto and South32, Russia's UC Rusal, Norway's Norsk Hydro and finally India's Hindalco (USGS, 2021) (OECD, 2019).

Primary aluminium

In 2020, the world primary aluminium production reached 65 Mt, a 250% increase compared to 2000, with a Chinese domination (56.7% compared to 8.6% in 1996). Far behind are India and Russia, each with a 5.5% market share, followed by Canada (4.8%) and the United Arab Emirates (4%).

Recent years have seen a decline in smelting capacity in OECD countries. For example, the United States, Canada and Australia together accounted for more than one-third of global aluminium production in 1996, compared to less than 10% today (USGS, 2021) (OECD, 2019).

China's Hongqiao Group has also overtaken Russia's Rusal in the global rankings, which now includes six Chinese companies in the top 10 aluminium producers. This leading group includes Alcoa, Rio Tinto and Emirates Global Aluminium, demonstrating the presence of highly integrated groups (OECD, 2019).

Should we be concerned about bauxite resources?

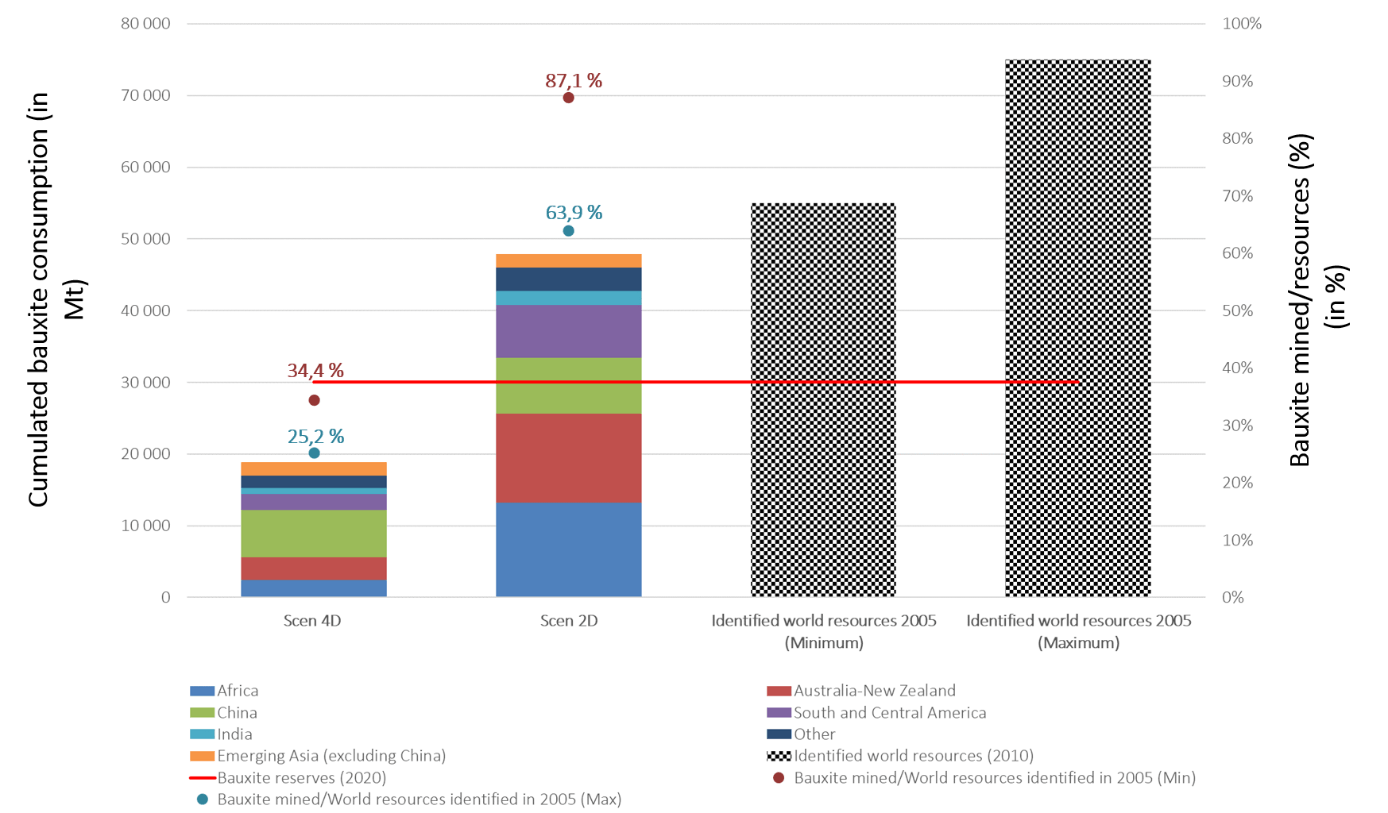

The IFPEN research team used the TIAM-IFPEN model to assess the cumulative demand for bauxite by 2050 based on two climate scenarios: a 4°C scenario corresponding to a temperature increase of 4°C above pre-industrial levels (4D scenario) and a more ambitious climate scenario limiting the temperature rise to 2°C (2D scenario).

The Paris Agreement: heading for more and more aluminium

Thanks to its remarkable properties, aluminium is likely to remain a key metal in our societies by 2050, especially in a climate scenario compatible with the goals of the Paris Agreement.

A high geological criticality in a 2°C scenario

In order to determine the impact of increased aluminium demand on bauxite resources, cumulative bauxite production to resource ratios were calculated for the 2D and 4D scenarios. Two estimates of bauxite resources are provided by the USGS: the lower estimate is 55 billion tons and the higher one is 75 billion tons.

Under the most optimistic resource estimate, the criticality level associated with bauxite ranges from 25.2% in the 4°C scenario to 63.9% in the 2°C scenario. These ratios increase 34.4% and 87.1% respectively if the most pessimistic estimate is assumed. The choice of resource assumption therefore has an impact on the geological criticality analysis. However, regardless of the assumption selected, the ratios obtained in the 2°C scenario indicate high pressure on bauxite resources (Figure 5).

Source: IFPEN

The modelling results also provide us some insight into the hierarchy of producing countries by 2050. Although the African continent gains in importance in a 2°C scenario, the distribution of production at the global level by 2050 remains similar to that of today. In the 4°C scenario, however, China becomes the leading bauxite mining producer with more than a third of the world's production, compared to just over 16% today.

The aluminium industry could therefore be facing resource scarcity under ambitious climate targets. However, this is just one of the challenges it will come up against in the decades to come.

What are the other risks facing aluminium ?

Aluminium: the environmental challenge

Aluminium is a key material for the energy transition and its demand is set to grow massively by 2050. The metal will be a great ally in the lightening of vehicles and an essential component in power infrastructures, solar panels and wind turbines. A decarbonised future therefore requires an increase in global production capacity.

However, this key metal for the energy transition is also a source of greenhouse gas emissions. The aluminium industry is very electricity intensive. In 2018, the sector alone accounted for 2% of global greenhouse gas emissions (IAI, 2021).

The carbon intensity of the aluminium obtained is closely linked to the electricity mix of the producing country: in Europe, particularly in countries with decarbonised domestic production from hydroelectric dams, geothermal and nuclear power (Norway, France, Iceland), the production of one ton of primary aluminium generates around 7 tons of CO2 equivalent (CO2e), while it produces more than 20 tons of CO2e in China, where the electricity used in smelters generally comes from coal-fired power plants (European Aluminium, 2019).

The International Aluminium Institute (2021) has calculated that in order to comply with the GHG reduction targets as defined in the International Energy Agency's (IEA) Beyond 2°C scenario (B2DS), the carbon footprint of primary aluminium production would need to be reduced from more than 16 tons CO2e/ton of aluminium (world average in 2018) to 2.5 tons CO2e/ton. Such an increase would require an estimated investment of $0.5-$1.5 trillion over the next 30 years.

While the carbon intensity of European primary aluminium production has already decreased by 55% since the 1990s, the effort required from China is much greater and could cause disruptions in domestic supply, as evidenced by the events of early 2021.

Having failed to meet its energy consumption targets, the city of Baotou in Inner Mongolia has been subject to aluminium production restrictions. Although these suspensions in production only involved small volumes, the reaction of the Shanghai Futures Exchange, China's leading commodity exchange, was strong: in March 2021, prices soared to their highest level in almost 10 years. The episode may seem anecdotal, but it does highlight a major challenge for this country that claims to be an "ecological civilization" (Hache, 2019): that of reconciling industrial and environmental policies.

A situation that raises questions: should we expect similar disruptions in the future? What would the implications be for the global market?

Aluminium, a critical metal for the European Union

In the latest update to its list of critical raw materials (European Commission, 2020), the European Union included bauxite for the first time. Although bauxite is used in many industrial ecosystems, very little of it is mined in Europe, making the EU highly dependent on imports (87%). One country in particular supplies the EU: Guinea. However, in a recent report (El Latunussa, 2020), the European Commission raises the problematic nature of this dependence on a country whose governance is described as weak.

It also concludes that European demand for both primary aluminium and bauxite is set to increase by 2050 and points to the risk of destabilization generated by Chinese appetite in these markets. Despite a 12-fold increase in its mining production since 1995, China now absorbs two-thirds of global bauxite imports (OECD, 2019). The Old Continent thus seems to be becoming aware of the uncertainties weighing on its aluminium supply, which could be exacerbated in a context of rapid and widespread growth in world demand.

Recycling as one of the answers

Aluminium is easily recyclable and can theoretically be endlessly reused without losing its outstanding properties. The limiting factors are therefore mainly the efficiency of collection systems and the long downtimes in the transport or construction sectors for example.

There are two advantages to this secondary production: firstly, secondary aluminium has a much smaller carbon footprint, making it a key element of the industry's decarbonisation strategy (IAI, 2021); secondly, secondary production improves the security of supply of consuming countries, and in fact, one third of European supply is already met via recycling (EC, 2020).

Points to remember

Because of its remarkable properties and its use in low-carbon technologies, aluminium is likely to remain a key metal in our societies by 2050.

The risks this metal is exposed to are:

- geologic: The TIAM-IFPEN model anticipates a high degree of geological criticality for the bauxite resources in a 2°C scenario;

- economic: the world production of alumina and aluminium is largely dominated by China;

- strategic: the EU is highly dependent on imports of bauxite, a metal which was recently added to its list of critical raw materials;

- environmental: as a major source of greenhouse gas emissions, the aluminium industry should experience an important mutation in the coming years.

To find out more

Decoding keys: Metals in the energy transition

>> BIBLIOGRAPHY

Scientific contacts : Emmanuel Hache, Charlène Barnet, Gondia Seck

To quote from this article : Hache, Emmanuel ; Barnet, Charlène ; Seck, Gondia-Sokhna «Aluminium in the energy transition: what lies ahead for this indispensable metal of the modern world? », Metals in the energy transition, n° 6, IFPEN, may 2021.