29.03.2021

10 minutes of reading

Omnipresent in our modern societies, nickel is essential to numerous industrial sectors and widely used in construction. This metal is not currently considered to be a critical metal. However, the rapid development of batteries for electric vehicles has accelerated demand in recent years, forcing the nickel industry to adapt accordingly.

- Nickel, an essential element for the stainless steel industry

- Where is nickel found? Who produces it? How is it produced?

- Should we be concerned about nickel resources?

- Towards a transformation of the nickel market?

- Nickel, the essentials on film

(Podcast in French)

Nickel, an essential element for the stainless steel industry

Particularly appreciated for its ductility, malleability and resistance to oxidation, nickel is best known for its use in stainless steels. This usage accounts for around 70% of global nickel demand. It is also employed in the manufacture of alloys (8%), in special steels (8%), in coatings (8%) and, increasingly, in electric batteries (5%).

Where is nickel found? Who produces it? How is it produced?

Resources and reserves distributed across (almost) every continent...

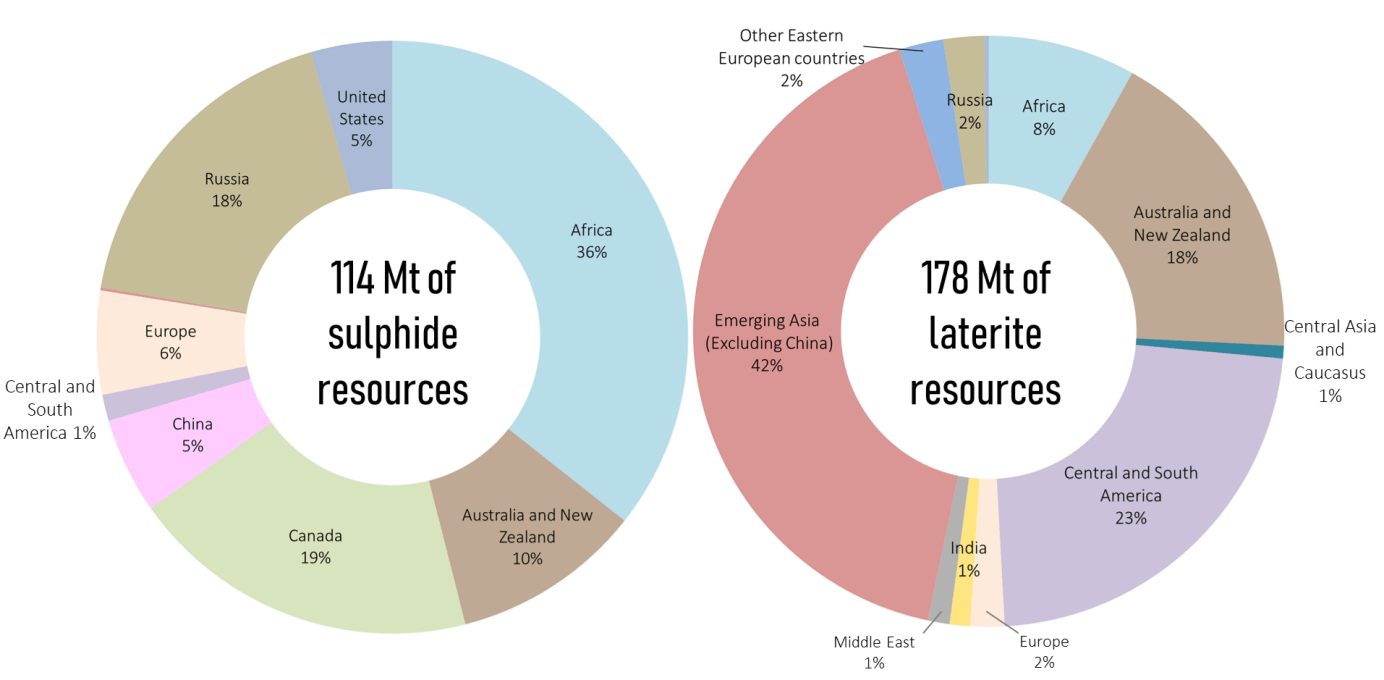

Nickel is rather well distributed around the globe with land resources estimated at 300 million metric tons, of which 60% correspond to laterite deposits (primarily in South-East Asia) and 40% to sulfide deposits (South Africa, Canada, Russia). Australia is the only country to boast significant quantities of both of these deposits (Graph 1). Laterite ores are easier to transform and were thus originally favored for the manufacture of nickel-based products (USGS, 2021) (Nickel Institute, 2016).

Source: Mudd and Jowitt, 2014

TIAM WORLD model: here

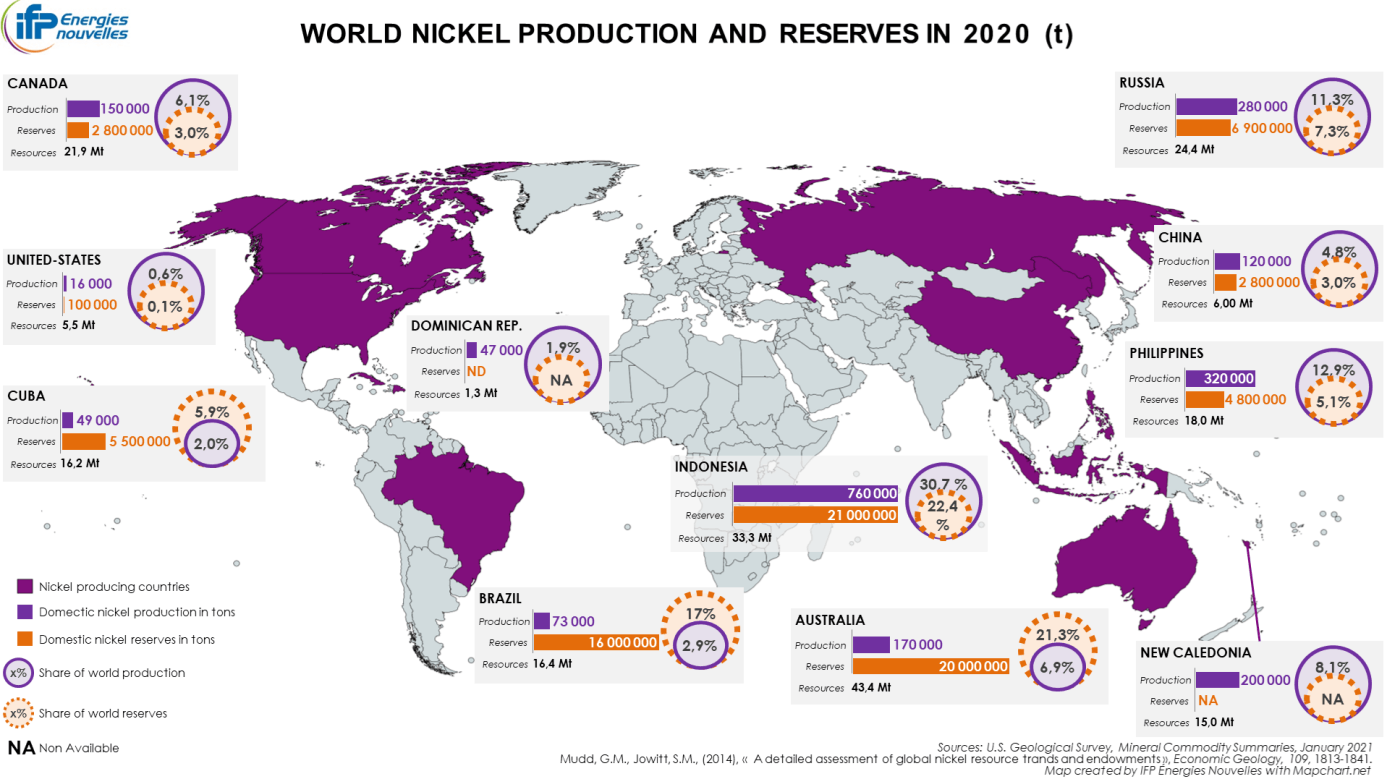

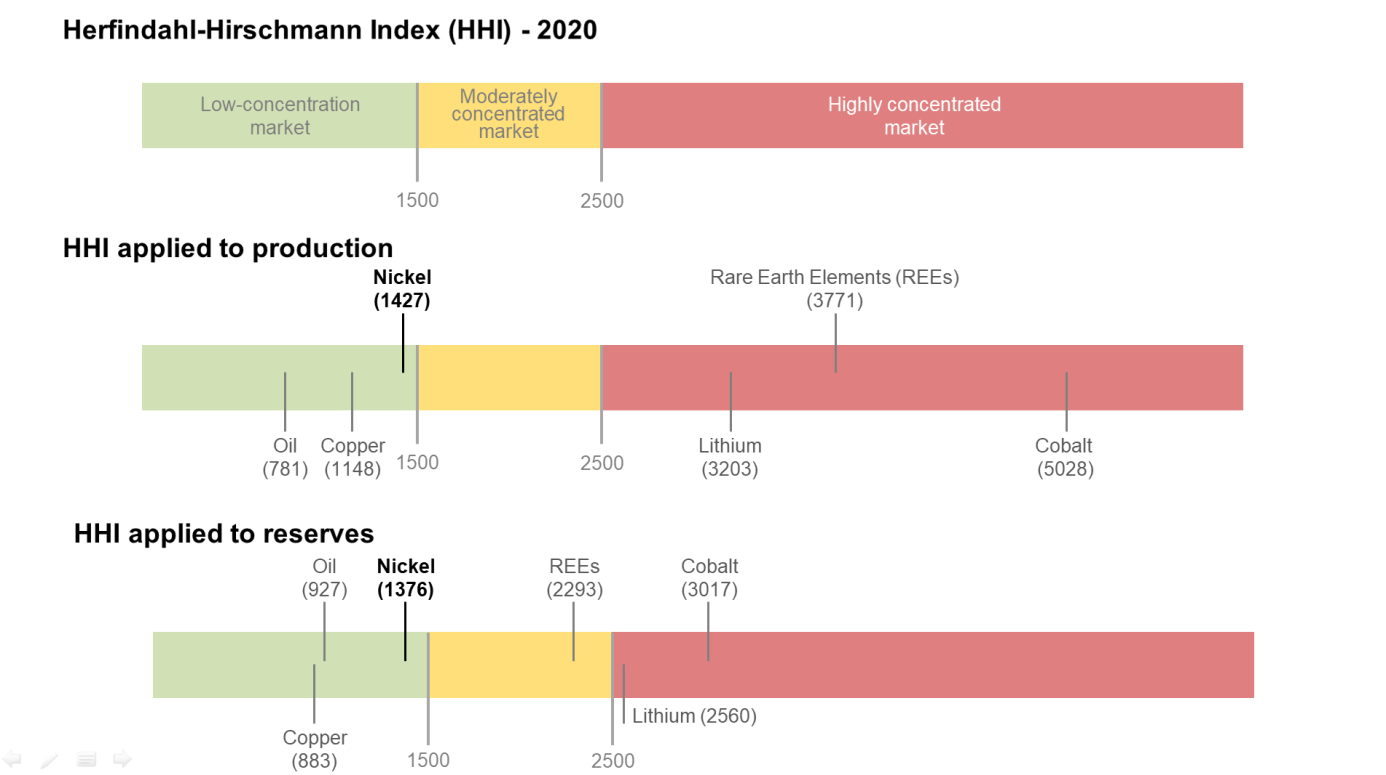

Nickel reserves are estimated to be 94 million metric tons and are mainly located in Indonesia (22.4%), Australia (21.3%), Brazil (17%), Russia (7.3%), Cuba (5.9%) and the Philippines (5.1%). It is also worth mentioning South Africa (3.9%), which, although not one of the leading producing countries, nevertheless has considerable sulfide-type reserves which might be of strategic importance for the future (Map 1). The concentration index of the reserves is quite low (HHI of 1,376, Graph 2). (USGS, 2019, 2021).

Source: USGS, 2021

Mining production is dominated by South-East Asia

In 2020, global mined nickel production reached around 2.5 million metric tons, down by almost 8% compared to the previous year. Nevertheless, it represented more than twice what was observed in 2000.

The geographic distribution of nickel mining production has undergone some significant changes in the last two decades. While the market had been dominated by Russia and Canada since the 1980s, today it is dominated by Indonesia (30.7% of global production in 2020) and the Philippines (12.9%). Next in the rankings are Russia (11.3%), New Caledonia (France) (8.1%), Australia (6.9%) and Canada (6.1%) (Map 1). Having seen its market share fall to its lowest levels in 2014 and 2017, Russia does nevertheless appear to have made up ground in recent years, unlike the Philippines whose influence in global mining production is following a downwards trend (Mudd, 2010; Zeng et al., 2018).

As for reserves, the global production level is not very concentrated (HHI of 1,427, Graph2) (USGS, 2021).

Source: USGS, 2021

The mining company market also appears to be subject to relatively low level of concentration. While at the start of the 2010s, the five biggest companies accounted for more than half of global nickel production (Têtu and Lasserre, 2017), today they represent less than one third of global extractions. This “top 5” is made up of Brazilian operator Vale, followed by the Russian company Norilsk Nickel, China’s Jinchuan Group, the Swiss firm Glencore and lastly the Australian group BHP.

Nickel products: different classes for different usages

Nickel products are divided into two categories depending on their degree of purity:

- Class I nickel has a nickel content of 99.98% or more and is generally found in sulfide deposits. Therefore it has a very high degree of purity and production costs are also high. Powders, briquettes, cathodes and granules belong to this category. Class 1 nickel is the best candidate for the production of nickel sulfates used in the manufacture of batteries.

Around 55% of global primary nickel production corresponds to class 1 nickel (The Nickel Institute, 2016). - Class 2 nickel (alloys and ferronickels, for example) from laterite deposits, has a lower degree of purity and is primarily used in the stainless steel industry.

Like mining extraction, the geography of primary nickel – obtained after smelting and refining nickel ore – production has also undergone transformations. In the mid-1990s, Russia, Canada, Brazil and a handful of European countries (Norway, Finland and the United Kingdom, in particular) dominated nickel smelting and refining activities. But over the course of time these countries have gradually seen their influence erode to be overtaken by countries in Asia. Hence in 2017, China accounted for 31.2% of nickel products, followed by Indonesia (10.3%) and Japan (9.4%). Russia (8.0%) and Canada (7.9%) complete the picture (INSG, 2019).

Global primary consumption dominated by China

Primary nickel consumption soared from the beginning of the 2010s. In 1996, demand came from Europe (38%) and Asia (37%), but in 2017 European countries only accounted for 16% of global consumption, while Asia represented almost three quarters. America accounted for 9% of demand and Africa barely figured in the ranking, with just 1% of global consumption (INSG, 2019).

The growth in primary nickel consumption has been mainly driven by China, which absorbed more than half of all nickel products in 2017 (INSG, 2019). This surge in Chinese demand can be explained by the significant increase in its stainless steel production, itself driven by the country’s rapid economic and social development since the start of the 2000s. In the space of a few years, China rose to the top of the rankings to become the leading stainless steel producer with a market share of 52% in 2015 compared to 3% in 2000 (Zeng et al., 2018).

Should we be concerned about nickel resources?

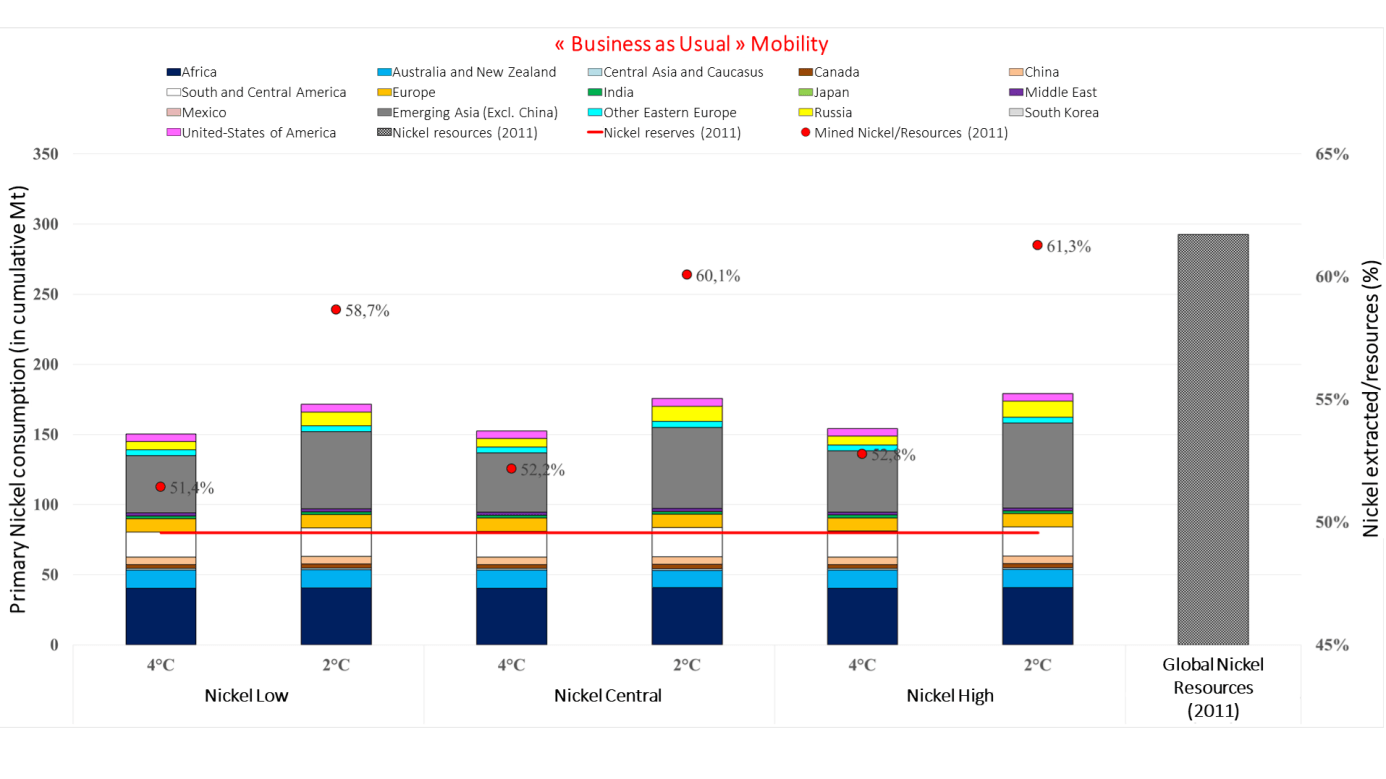

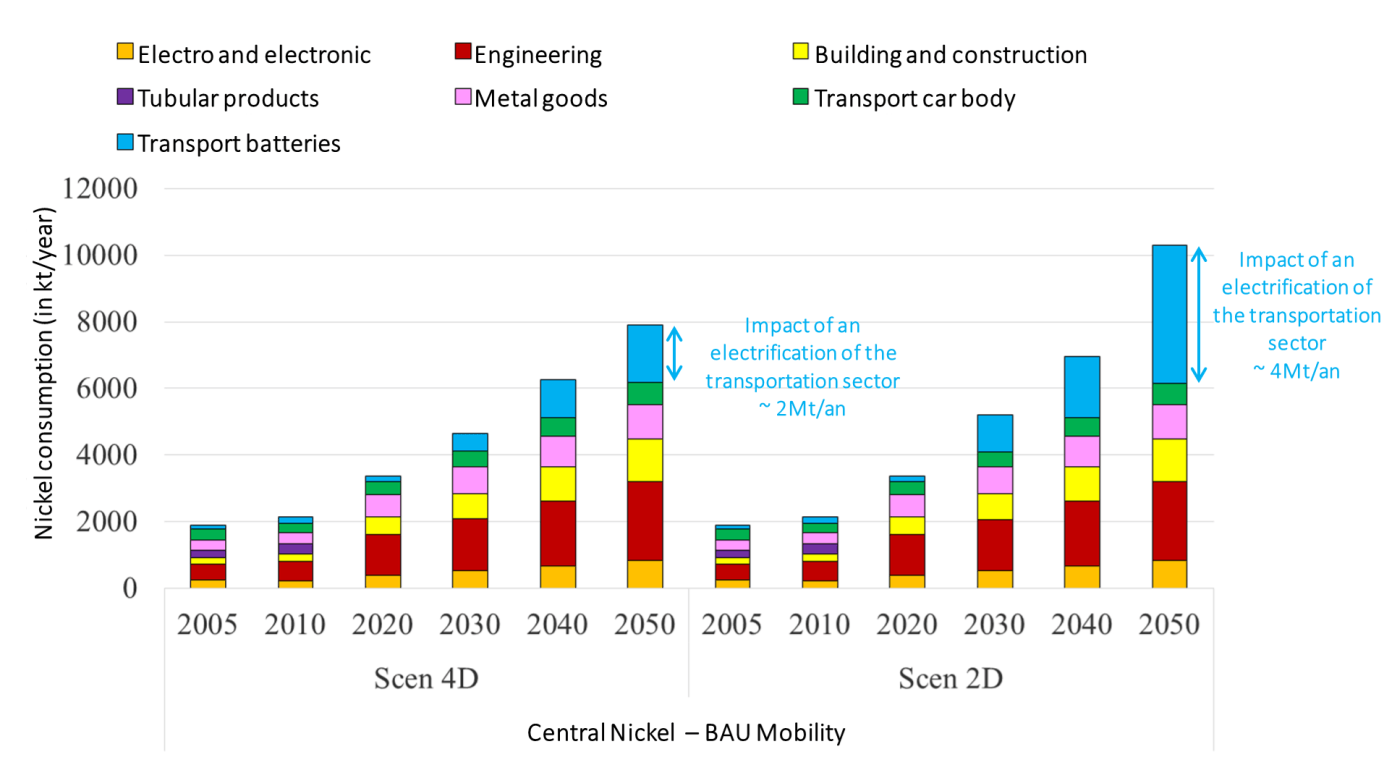

The IFPEN research team used the TIAM-IFPEN model to evaluate the cumulative demand for nickel for the period to 2050 on the basis of two climate scenarios: a 4°C scenario corresponding to a temperature increase of 4°C above pre-industrial levels (4D scenario) and a more ambitious climate scenario limiting the temperature rise to 2°C (2D scenario).

It then applied two mobility scenarios to each of these climate scenarios: the first, associated with a “Business As Usual” (BAU) scenario, corresponds to a continuous rise in the rate of vehicle ownership and a greater reliance on cars. The second is associated with a sustainable mobility scenario, which prioritizes the use of public and non-motorized transport, as well as an integrated planning and investment approach related to regional development and urban transport.

For each mobility scenario, the research team considered three mixes of Lithium-ion battery chemistries, identical to those studied for cobalt:

- a mix with a high cobalt content that would correspond to a lower nickel content (10% NCA, 90% NMC622);

- an intermediate mix (10% NCA, 40% NMC622, 50% NMC811);

- a mix with a low cobalt content that would correspond to a higher nickel content (10% NCA, 90% NMC811) by 2050.

Did you know?

Among Lithium-ion batteries, there are five main technologies that can be used for the purposes of electric mobility solutions. They differ depending on their chemical mixture:

*Lithium cobalt oxide (LCO);

*Nickel-manganese-cobalt (NMC);

*Nickel-cobalt-aluminum (NCA);

*Lithium ferrous phosphate (LFP);

*Lithium manganese oxide (LMO).

Paris Agreement: towards the mass electrification of the vehicle fleet

Using the TIAM-IFPEN model (Hache et al., 2019), the team evaluated the evolution of the global vehicle fleet out to the year 2050. In the case of climate objectives in line with the ambitions set out in the Paris Climate Agreement and with a BAU mobility, it anticipates a mass electrification of the vehicle fleet (50% EVs).

Moderate geological criticality despite the increase in primary demand

To evaluate the degree of criticality associated with nickel, the team calculated cumulative demand ratios for the period to 2050 on the basis of known resources in 2011, varying the three battery technology mix types.

Source: IFPEN

Within the context of BAU mobility and irrespective of the battery technology considered, the cumulative nickel/resources production ratio is higher in the 2°C scenarios than in the 4°C scenarios. This ratio ranges from 58.7% to 61.3% for the 2°C scenarios compared to 51.4% to 52,.8% for the 4°C scenarios (Graph 3). The observation is the same when more sustainable mobility policies are implemented.

It can also be observed that technological choices made concerning batteries influence the level of pressure on nickel resources. Today, the trend is towards an increase in the share of nickel in lithium-ion batteries, often replacing cobalt, an expensive metal associated with a more precarious supply security.

Lastly, opting for sustainable mobility policies reduces pressure on nickel resources. In the most constrained scenario – a 2°C scenario with more nickel-intensive battery technologies – the ratio is 61.3% in the case of a conventional mobility policy and 59.2% in the case of sustainable mobility.

Moreover, the projected scenarios make it possible to confirm the position of Asian countries as the leading global producers of nickel in 2050 and highlight the key role that Africa is likely to play in future global supply.

These results suggest a moderate level of geological criticality for nickel: below that observed for copper or cobalt, it is above that identified for rare earths and lithium. Pressure on nickel resources must now be analyzed in terms of the distinction between class 1 nickel and class 2 nickel.

Towards a transformation of the nickel market?

Class 1 nickel and electrification: towards a necessary adaptation of the sector?

Used in the battery sector, class 1 nickel may experience a surge in demand over the coming years. In the case of a BAU mobility scenario with moderately nickel-intensive battery technologies, the electrification of the transport sector alone would increase global demand from 6 Mt/year to 8 Mt/year in a 4°C scenario. It would even exceed 10 Mt/year in a 2°C scenario in 2050 (European Commission forecasts suggest a consumption of 2.6 Mt/year for batteries destined for the transport sector by 2040)! (Fraser, 2021) (Graph 4).

Source: IFPEN

Despite this, the production of high-quality nickel may be insufficient in the medium term for several reasons. Firstly, hitherto the increase in production capacities has concerned class 2 nickel. For many years, the metal’s low price has not encouraged investments in class 1 nickel production, which is more costly.

Class 1 nickel can be produced from sulfide deposits, a process that requires a high level of initial investment due to the depth of these deposits. It can also be produced from laterite ores, but while the mining is easier, their quality is lower, generating additional costs to upgrade them to class 1 nickel (Campagnol, 2017).

Secondly, fewer sulfide deposits with the potential to produce class 1 nickel have been discovered than laterite deposits over the course of the last 20 years. Finally, class 1 nickel is also employed in the stainless steel industry, which places additional pressures on this category (EC, 2018; Murphy, 2020; Fraser, 2021).

Securing the supply of class 1 nickel will thus require the commissioning of new mining sites, as well as additional production capacities targeting intermediate and refined products. Countries with a rich pool of sulfide-type resources could thus benefit from the future boom in class 1 nickel.

With its significant reserves, Russia seems to be well placed to reassert its position in the ranking of mining producers. In fact, Nornickel is already one of the biggest global producers of class 1 nickel. The large-scale roll-out of electric vehicles also represents an opportunity for South Africa as well as central and eastern Africa where increasing numbers of exploration projects are springing up (USGS, 2019).

It is highly likely that Indonesia and the Philippines, while endowed with laterite deposits, also have a role to play in the security of nickel supply for the battery industry. While sulfide deposits provide the basis for class 1 nickel production for reasons of simplicity, it is also possible to produce, via high pressure acid leaching (HPAL), a sulfide/hydroxide mixture that can be used as a raw material for the production of nickel sulfate.

This is the type of infrastructure that Indonesia has undertaken to develop with the aim of asserting itself downstream in the battery value chain. The country has launched several HPAL plant projects while two such plants are already operational in the Philippines (Fraser, 2021).

The supply of primary nickel from these two countries remains uncertain, as demonstrated by recent events: hoping to take full advantage of the economic benefits stemming from the production of these resources, Indonesia announced a ban on the export of nickel ore, starting the 1st of January 2020. As a result, consumer countries, led by China, stockpiled the commodity, resulting in a 60% increase in prices between January and September 2019. Concerned about the environmental impact of extraction activities, the Philippine government has stated its intention to introduce stricter regulations for the mining sector, even if this means closing some sites, further reinforcing fears of shortages.

Not all consumer countries are affected by class I nickel supply risk in the same way. China, the world’s leading nickel consumer, is heavily reliant on Indonesia and the Philippines for its supplies, and therefore the strategies adopted by the two countries. The USA deem the security of their nickel supplies to be satisfactory and have not included this metal in their list of 35 critical metals despite their low domestic production levels. Nevertheless, vehicle manufacturers such as TESLA have warned of the need to increase global class 1 nickel production. However, the country seems to be able to rely on its proximity to its Canadian neighbor, which boasts significant sulfide reserves.

Finally, the European case raises questions. While nickel production in Europe is anecdotal (around 2% in 2016 (USGS, 2016), the metal does not figure in the list of critical metals drawn up by the European Commission. And yet, the European Union has ambitions to become a leading player in the manufacture of batteries for electric vehicles, an ambition reflected in the launch in 2017 of the European Battery Alliance, known as the “Airbus for Batteries”, an industrial sector development project aimed at reducing the continent’s reliance on countries such as China and Korea. In one of its most recent reports on the subject, the European Commission nevertheless warned of a probable nickel supply shortage for its battery manufacturers by the end of the 2020s, stressing the need to establish a robust battery recycling sector (Fraser, 2021).

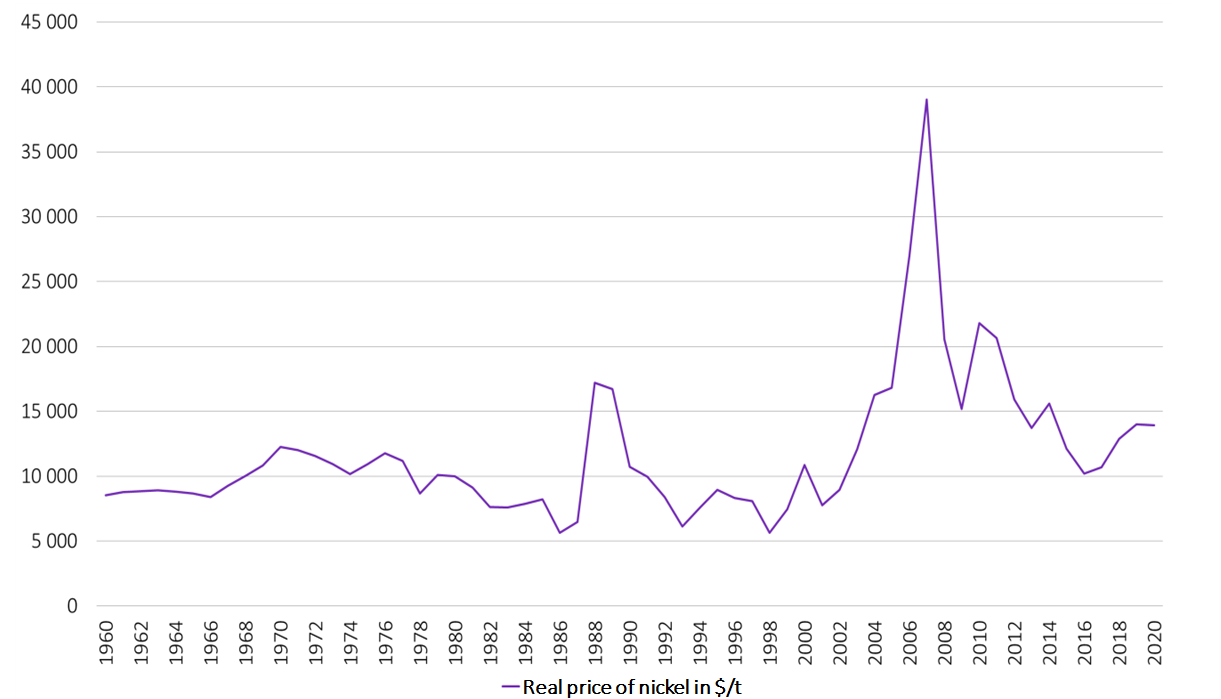

Volatile nickel prices could hamper investments

Nickel, listed daily on the London Metal Exchange, is reputed to be one of the most volatile metals (Graph 5), leading it to be called the “devil’s metal”. Numerous factors influence the price of this metal, but in recent years, the uncertainty linked to the commercial and industrial policies of the major producing countries - particularly Indonesia and the Philippines - has been the biggest driver of price variations. Despite recent increases, nickel prices remain low compared to those seen in the period 2007 to 2008 when they reached almost 40,000 dollars per metric ton.

Source: World Bank

The structural volatility of the markets and the price levels observed today do not encourage investment in this sector or that of nickel transformation – particularly for class 1 nickel–, auguring a potential supply shortage by 2030.

Points to remember

The electrification of the vehicle fleet could cause the multiplication by 4 of the nickel demand in a 2 °C scenario.

The risks this metal is exposed to are therefore economic and strategic:

- The extraction and transformation of high-quality nickel that is used for batteries could be a problem;

- Structural price volatility doesn't encourage an increase of investments in class 1 nickel production and transformation;

- Consumer countries, European states in particular, are threatened by increasing dependence and supply disruptions could emerge within the next ten years.

To find out more

Metals in the energy transition

Find all the points on this video:

>> BIBLIOGRAPHY

Scientific contacts : Emmanuel Hache, Charlène Barnet, Gondia Seck

To quote from this article : Hache, Emmanuel ; Barnet, Charlène ; Seck, Gondia-Sokhna «Nickel in the energy transition: why is it called the devil’s metal? », Metals in the energy transition, n° 5, IFPEN, March 2021.