12.11.2020

8 minutes of reading

While the widespread use of low-carbon technologies in the energy transition seems to reduce dependence on fossil fuels, it may in reality creates new ones as renewable energies and electric mobility are very material-intensive. With this article, a focus is made on cobalt, a favored metal of the energy transition, which the research team of the Economics and Environmental Evaluation Department at IFPEN finds critical in more than one respect.

- The wide use of cobalt in batteries and green technologies

- Where is cobalt found ? Who produces it ? Who consumes it ?

- What risks is facing cobalt supply ?

- How can supply risks be mitigated ?

- Points to remember: all the key elements about cobalt in a video

Podcast (French version)

The wide use of cobalt in batteries and green technologies

Cobalt has the special feature of having a high melting point and retaining its strength and magnetic properties even at extreme temperatures. This makes it a key component for many strategic fields, such as aerospace, defense, chemistry, and much more. Among other things, it is found as a component of superalloys used in gas turbines and nuclear reactors, but also in radar magnets, missile guidance systems, marine propulsion systems and sensors.

However, cobalt owes its current visibility to its increasing use in low-carbon technologies, also known as green technologies (renewable energies and rechargeable batteries): it is found notably in the magnets of wind turbines, but also and above all in the cathodes of lithium-ion batteries and nickel metal hydride batteries used in electric or hybrid vehicles (Slack et al., 2017).

Where is cobalt found ? Who produces it ? Who consumes it ? - Overview

A concentration of cobalt resources and reserves in the Copperbelt

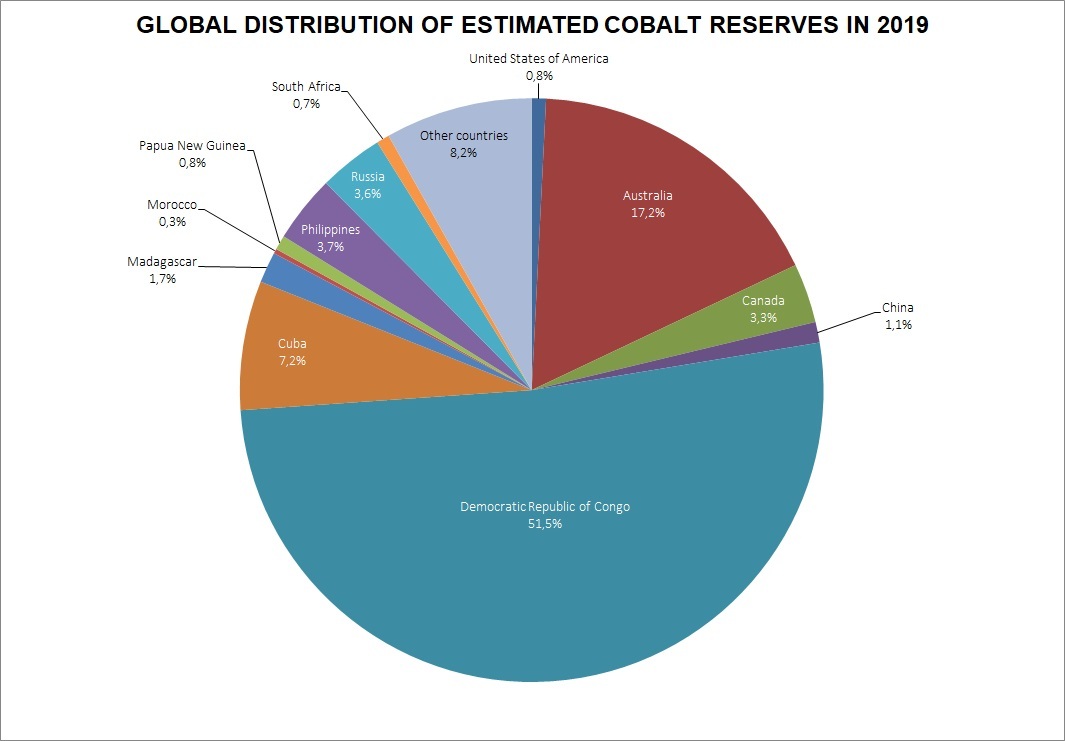

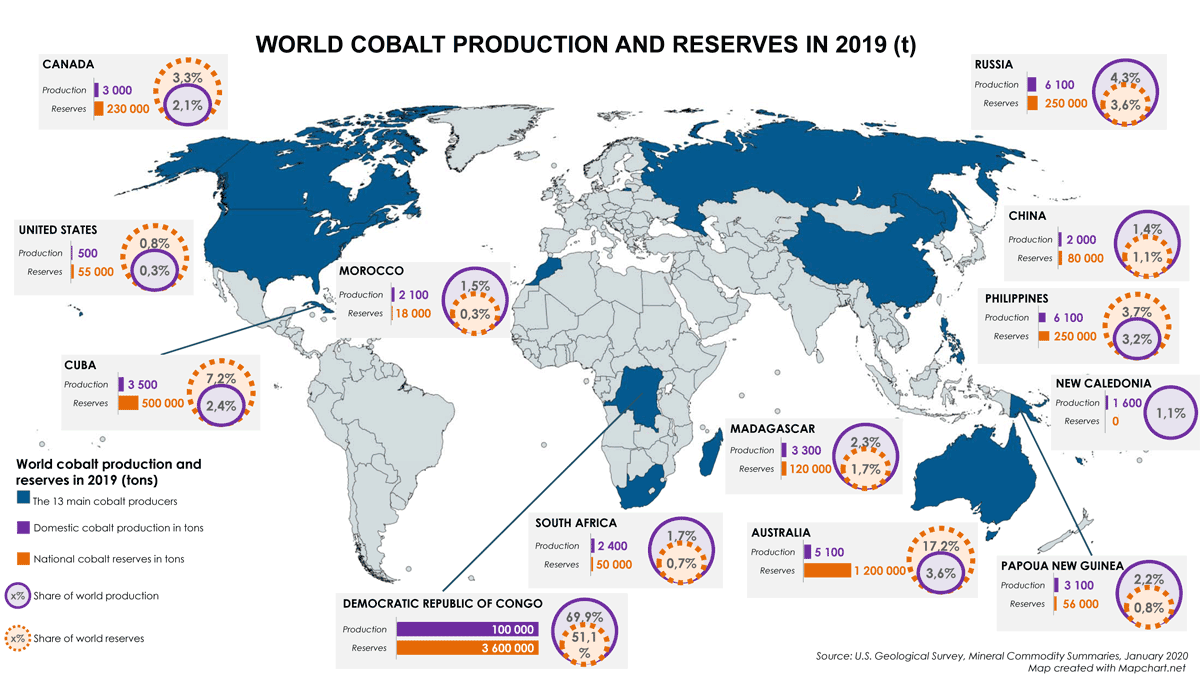

The earth's cobalt resources amount to 25 million tons (USGS, 2020). Most of these resources are located in the Copperbelt, a mining area that includes part of the Kantanga Province in the Democratic Republic of the Congo (DRC).

The remaining resources are mainly located in Australia, Cuba, Canada, Russia and the United States. An additional 120 million tons of cobalt could also be found at the bottom of the Atlantic, Indian and Pacific Oceans (USGS, 2020). However, their extraction is not yet feasible due to significant technological, economic and legal barriers.

Source: USGS

In 2019, the world's cobalt reserves were estimated at 7 million tons, more than 50% of which are located in the DRC. Australia (17.2%) and Cuba (7.2%) also have significant reserves (Chart 1).

Did you know? Source: ADEME

The resources include all known deposits that could be extracted when technical and economic conditions permit. It is a scope with essentially geological characteristics.

Reserves correspond to the share of resources that can be technically and, above all, economically extracted, at the time they are declared, according to a certain number of parameters (overall volume of the deposit, desired metal content, depth, geological nature, social-environmental factors and price of the raw materials considered). This concept combines geological and economic data.

The Democratic Republic of the Congo, the leading producer of cobalt

World cobalt production has been steadily increasing since the mid-1990s, peaking at 148,000 tons in 2018 and an estimated 143,000 tons for the following year (USGS) (Chart 2).

.jpg)

Source: USGS

Cobalt production reflects the unequal distribution of the earth's resources. In 2019, nearly 70% of mining production came from the DRC, compared to only 21% of global mining in 2000. Among the most prominent producers are Russia with 6,100 tons or 4.3% of world production and Australia with 5,100 tons, accounting for 3.6% of the total. The share of each of the other "big" producing countries - the Philippines, Cuba, Madagascar, Canada, Morocco, China and New Caledonia - does not exceed 3.2%. Extractive activities are therefore highly concentrated geographically (Chart 3).

The same is true for refining, which is 50% controlled by China (Gulley et al., 2019), compared to 3% in 2000, with the rest being carried out mainly in Finland, Belgium and Canada.

Source: USGS

China, the leading consumer of cobalt

China, Japan and the United States are the world's largest consumers of cobalt. In 2019, China topped the podium and 80% of the cobalt consumed there is used in the manufacture of batteries (USGS).

What risks is facing cobalt supply ?

High geological criticality

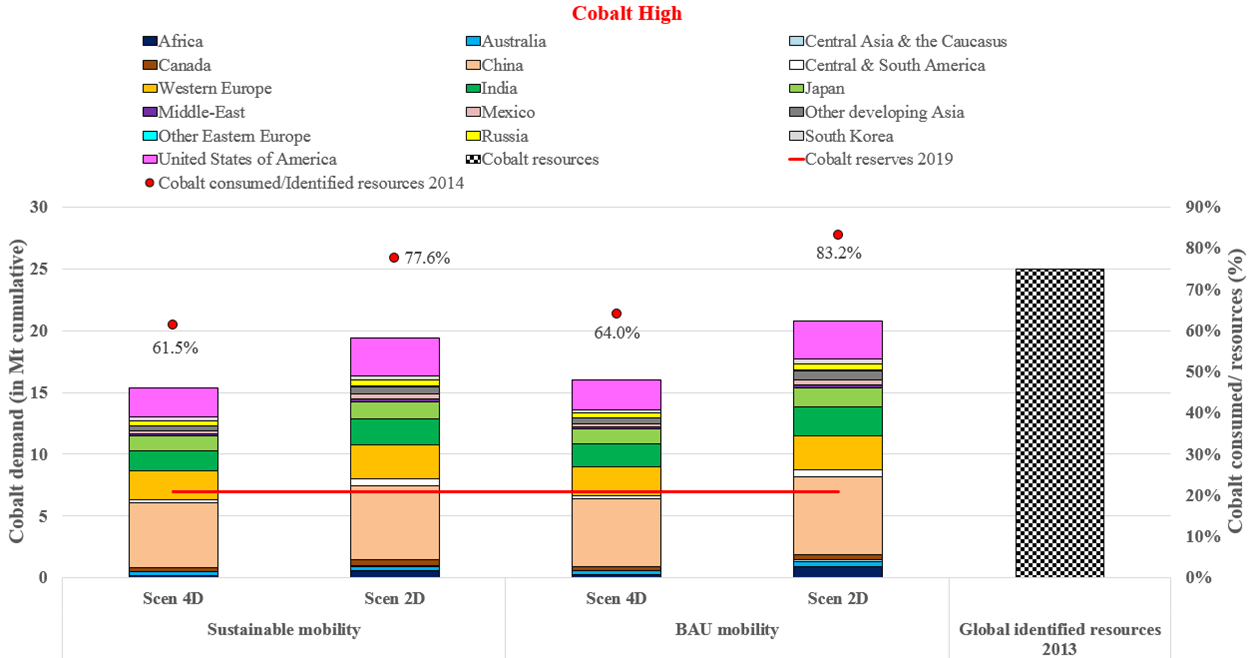

In order to assess the availability of cobalt until 2050, the TIAM-IFPEN model was used. Two climate scenarios (2D (2°C) and 4D (4°C) were considered, each with two different mobility scenarios: Business As Usual (BAU) mobility - a continuous increase in ownership and an equivalent dependence on the car as observed today - and sustainable mobility - stronger fiscal and regulatory policies with priority given to sustainable mobility modes such as public and non-motorized transport.

For each mobility scenario, three lithium-ion battery chemistry mix trajectories were considered: one with a high cobalt content (10% NCA, 90% NMC622), one in-between (10% NCA, 40% NMC622) and a low cobalt content mix (10% NCA, 90% NMC811) by 2050.

In order to assess the level of criticality related to cobalt, cumulative demand ratios to 2050 in relation to currently known resources were calculated by varying the three groups of parameters previously described.

The results obtained show a higher pressure on cobalt resources in a 2°C scenario: based on a BAU mobility scenario with a mix of high cobalt content lithium-ion batteries , the cumulative demand ratio of cobalt to resources increases from 64% in the case of a 4°C climate scenario to 83.2% in the case of a more ambitious climate scenario. The latter ratio means that 83.2% of cobalt resources would be consumed between 2013 and 2050 in such a scenario (Chart 4).

Source: IFPEN

Mobility policies also have an impact on the criticality of cobalt: whatever is the climate scenario considered, the adoption of so-called sustainable mobility reduces the pressure on cobalt resources (Chart 4).

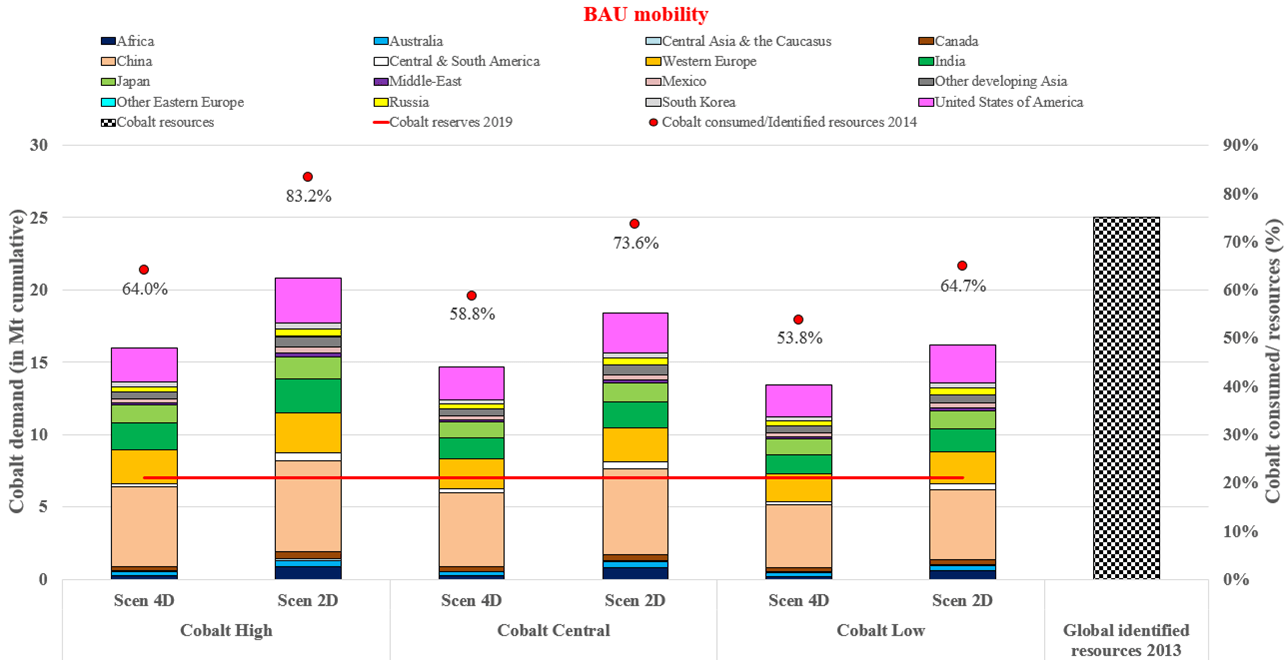

The type of battery technology chosen also influences the level of criticality associated with cobalt by 2050. Thus, in the case of a 2D scenario with BAU mobility, the adoption of technologies with low cobalt content reduces the cumulative consumption/resource ratio from 83.2% to 64.7% (Chart 5).

Source: IFPEN

The results project therefore suggest a high level of geological criticality in the case of the most constrained scenarios. If we consider that a limitation of global warming to 2D will be the selected objective, two levers can then be harnessed in order to moderate the pressure on cobalt resources.

Firstly, promoting low cobalt intensity battery technologies seems to be the most efficient way to reduce cobalt-related criticality. Secondly, the results of the modelling work also show the positive impact of the implementation of sustainable mobility policies on the criticality level of the blue metal. Finally, recycling is expected to play a key role in meeting the strong increase in demand for cobalt by 2050.

A particularly fragile economic and strategic situation

Cobalt, a by-product of copper and nickel mines

In 2015, 98% of the cobalt extracted from the ground was a by-product of copper or nickel mines. Only the Bou-Azzer mine in Morocco has made cobalt its main product. This characteristic of cobalt enhances the supply risk associated with it because the amount of by-product generated by mining activities is closely related to the amount of main metals produced. As a result, the ability of the cobalt market to adapt to a strong increase in demand is limited.

Furthermore, the demand for cobalt is not very sensitive to price variations. In the event of a sharp rise in prices, the cobalt market will respond in three ways: by increasing recycled volumes, by relying on technological innovations to extract a wider range of resources and by mobilizing more informal production of cobalt from DRC (Campbell, 2019).

Cobalt, "blood diamond" according to NGOs

More than 70% of cobalt mined production is controlled by the DRC (USGS, 2020) compared to 28% in 2000 (Shedd et al., 2017); however, the country suffers from strong political instability as well as a worrying security situation with many conflict zones in the east of the country.

Hazardous working conditions, exposure to potentially carcinogenic dust, child labor, as well as a proliferation of illegal mines linked to the high market value of cobalt, have earned it the nickname "Blood Diamond" of the decade.

As a result of the bad publicity they received in the face of NGO accusations, cobalt end users (battery manufacturers, electronics companies) are now trying to trace their cobalt supply chain more clearly and diversify their sources. However, more than half of the world's cobalt reserves are located in the DRC. It is therefore unlikely that mining production will be subject to a major geographical redistribution.

When Chinese power secures its supplies

Secondly, a state of dependence also exists for refining and seems to intensify: Chinese refineries account for 50% of the world's volume, compared with only 3% in 2000 (Gulley, 2019).

The Chinese power has also implemented a strategy of investments abroad to secure its supplies of metals considered to be strategic. So, if, by 2016, the share of foreign cobalt production held by Chinese entities is added to domestic production, China's influence will increase from 2% to 14% for cobalt extraction and from 11% to 33% for the production of intermediate cobalt products (Gulley, 2019).

These figures highlight the risk that a country gaining importance in the value chain may pose: China's strategy to secure its supply potentially reduces the amount of cobalt available to other consumer states (Gulley, 2019).

What are the environmental and health risks associated with cobalt ?

Lastly, although it is an unavoidable component for certain low-carbon technologies, cobalt – mainly mining and refining activities – has an environmental impact that needs to be taken into account. For example, cobalt mining is energy-intensive from fossil resources, which contributes to global warming.

Such operations also have a significant health impact for the miners and the populations located in the areas concerned. It has also been shown that cobalt production emits various types of pollution.

This metal illustrates the fact that, far from spelling the end of dependence on raw materials, the energy transition and the electrification of modes of mobility bring new constraints linked to other types of resources.

How can supply risks be mitigated ?

Governments and companies are pursuing or considering several avenues: firstly, diversification of supply sources; secondly, technological innovation through the design of batteries that consume less cobalt (or the use of other types of batteries); and thirdly, the collection and recycling of electronic waste and batteries.

Thus, while secondary sources of cobalt are still under-exploited today, they could be an important resource in the future.

Points to remember:

1. Cobalt is a highly requested metal for green technologies driving the energy transition. 80% of cobalt is consumed in the manufacture of lithium-ion batteries.

2. According to the modeI, 83,2 % of cobalt resources known in 2010 would be consumed in 2050 in a 2°C climate scenario.

3. There are many other risks associated with this metal:

- Economic: by-product of copper and nickel mines, and little sensitivity to price variations;

- Strategic: production localized in the DRC; chinese influence on the value chain;

- Corporate social responsibility: working conditions, child labor, products traceability;

- Environmental: health impact on minors and local pollution.

To find out more

Metals in the energy transition

Find all the points on this video:

>> BIBLIOGRAPHY

Scientific contacts : Emmanuel Hache, Charlène Barnet, Gondia Seck

To quote from this article: Hache, Emmanuel ; Barnet, Charlène ; Seck, Gondia-Sokhna «Cobalt in the energy transition: a closer look at supply risks», Metals in the energy transition, n° 1, IFPEN, November 2020.